Blogs to enlighten

At Wiserfunding, we value expert knowledge and continually explore new ways to turn risks into opportunities.

Blogs to

enlighten

At Wiserfunding we believe in challenging the status quo, exploring better ways of doing things and inspiring new ways of thinking.

Explore our blog for the latest news, expert insights, and in-depth research on Credit Risk and Portfolio Management

Key Credit Risks From the IMF’s Global Financial Stability Report

Lending Into Fragility: Key Risks From the IMF’s Global Financial Stability Report For lenders navigating deteriorating credit conditions, the IMF’s [...]

12 March 2025

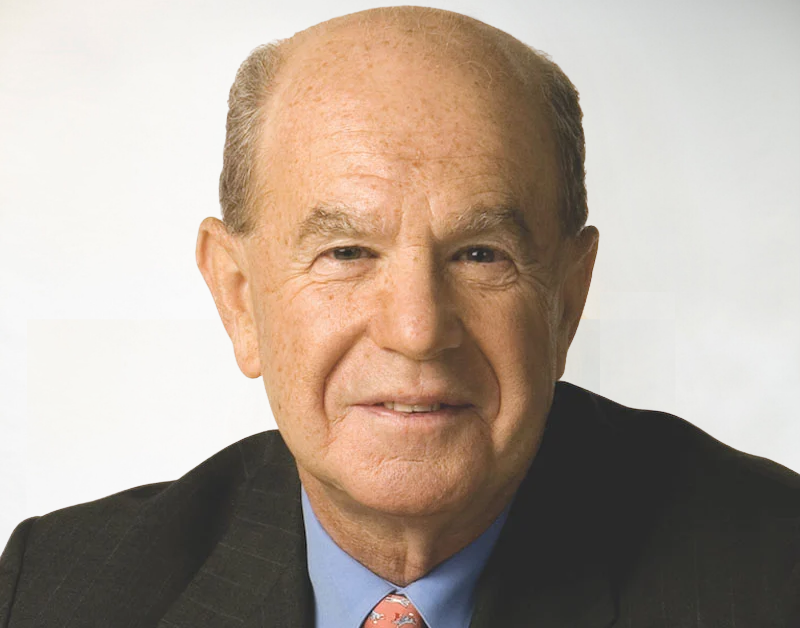

Stock Sell-Off Leads to Nasdaq’s Worst Day Since 2022

Are Credit Markets Signaling Trouble? Insights from Professor Edward Altman on Systemic Risks and Defaults in His Bloomberg Interview. [...]

Wiserfunding Attends Private Credit Connect in London 2025

We are excited to announce that Wiserfunding will attend Private Credit Connect London on March 26th. This exclusive event [...]

9 January 2025

Private Credit in 2025: Growing Through Change and Challenge

As we enter 2025, the global economic outlook is cautiously optimistic, yet private lenders may face unexpected challenges. With central [...]

7 January 2025

Automated Platforms in Private Credit Risk 2025

💡 The Future of Automated Credit Risk Assessment: What’s Next for Private Lenders in 2025? As private lending continues to [...]

17 October 2024

Understanding DORA: EU Financial Sector Digital Operational Resilience

The Digital Operational Resilience Act (DORA) is a critical initiative aimed at enhancing the operational resilience of the financial [...]

Wiserfunding Joins the Annual General Meeting of Berne Union

In this week’s newsletter, we’re excited to highlight the BerneUnion, the world’s largest trade association in the export credit [...]

26 September 2024

The Value of Unstructured Data in Credit Risk Assessment

Recent changes in market expectations, particularly regarding a potential interest rate cut by the Bank of England, prompt lenders [...]

12 September 2024

Webinar: How is Global Uncertainty Affecting the Credit Cycle?

On September 11th, we hosted an insightful webinar on How Global Uncertainty is Affecting the Credit Cycle Here [...]

9 September 2024

Unprecedented Measures: How Asset Managers Are Adapting to a New Era

The asset management industry is at a crossroads, facing unprecedented challenges and opportunities. The latest report from KPMG highlights [...]

23 August 2024

Gabrielle Sabato’s talk on the Impact of AI on credit risk management

In the recent "Code and Capital" video series by Finovate, Gabriele Sabato, co-founder and CEO of Wiserfunding, explored the [...]

21 August 2024

How AI Transforms Lending: Insights for SME Finance

How AI Drives Our Solutions at Wiserfunding At Wiserfunding, AI is at the heart of our cutting-edge solutions. Our [...]

16 August 2024

Future of Global Trade by 2032: Strategic Scenarios for Financial Institutions Operating Internationally

Global instability from financial crises, the pandemic, and geopolitical conflicts makes traditional planning insufficient. In this context, ECAs are [...]

14 August 2024

Export Credit Agencies in a Global Trade Landscape – Review Q1 2024

The latest Global Trade Update (July 2024) from UNCTAD reveals a landscape of recovery and change in global trade. [...]

8 August 2024

Zombie Firms: The Transformative Impact of Private Credit and Bankruptcy Reforms

The rise of zombie firms is a growing concern in today's economy. Extended low interest rates and economic disruptions [...]

2 August 2024

The Rise of Private Credit

The Rise of Private Credit: Transforming Corporate Debt and Governance Over the past generation, corporate America’s debt markets have undergone [...]

31 July 2024

Embracing Generative AI in Credit Risk

Embracing Generative AI in Credit Risk: A Transformative Opportunity Generative AI is rapidly gaining traction in various industries, including the [...]

24 July 2024

Where are we in the credit cycle? 2024 Outlook

From Average to Stressed Scenario for 2024: Preventing the risks Based on the 50 Years of Research of Edward I. [...]

28 June 2024

How Lenderwize is transforming telecommunications financing with Wiserfunding

“Wiserfunding gives us a complete and uniform tool for analysis that should be the industry standard. It blows away [...]

25 June 2024

Lending platforms are setting the standard for credit risk intelligence and operational efficiency – by being data-driven

Leveraging technology to harness the full potential of data has never been more critical and there's no question that it's [...]

13 May 2024

The future of credit risk intelligence

The future of credit risk intelligence is rapidly evolving, especially in the context of enhancing portfolio monitoring for SME clients [...]

13 May 2024

Driving growth through effective risk management

In the dynamic and competitive world of leasing, driving sustainable growth requires more than just expanding the lease portfolio—it necessitates [...]

9 May 2024

How LCI improved credit efficiency by 80% using Wiserfunding

“Since onboarding Wiserfunding as a management and decision making tool, our turnaround time dropped from a week to a [...]

8 May 2024

How Playter makes instant credit decisions to scale sustainably with Wiserfunding and Codat

Who Are Playter? Playter is a B2B Buy Now, Pay Later (BNPL) solution that empowers small and medium [...]

1 May 2024

The value of management accounts for risk analysis

The ability to accurately assess SME risk is crucial. Yet, traditional methods often fall short, relying on outdated financial data [...]

10 April 2024

Embracing technology for strategic advantage

The strategies and techniques employed to evaluate and mitigate risks are crucial to the health and success of banks and [...]

27 March 2024

How Capital On Tap Accelerates Credit Decisions

Who Are Capital On Tap? Capital on Tap provides an all-in-one small business credit card and spend management [...]

7 March 2024

The future of risk management in banking – navigating transformational change

Over the past decade, risk management within the banking sector has undergone a seismic shift, catalysed by the aftermath of [...]

6 March 2024

Six structural trends shaping the future of Bank Risk Management

The landscape of bank risk management is constantly evolving, shaped by a myriad of factors including regulatory changes, technological advancements [...]

6 March 2024

Enabling Polish exporters – a conversation with KUKE’s CEO

The importance of SME initiatives The Wiserfunding team had the pleasure of welcoming the KUKE team to our office last [...]

6 March 2024

Empowering women in work life

Driving diversity and inclusion International Women’s Day is more than just a celebration of women's achievements; it's a global call [...]

Revolutionising SME credit risk assessment with Wiserfunding and KUKE partnership

In a groundbreaking move that promises to redefine the landscape of SME credit risk assessment, the partnership between KUKE and [...]

The future of export credit: Leveraging tech & intelligence for better risk assessment

The landscape of export credit, a critical component of global trade, is undergoing a transformative shift. This change is driven [...]

Balancing risk and opportunity in a globalised world

At the heart of international trade and economic growth, Export Credit Agencies (ECAs) are more than just institutions; they're the [...]

The power behind our SME risk models

Insights from models based on 30 million data points In the intricate landscape of credit risk assessment, precision holds the [...]

How ‘multi-search’ is revolutionising risk management

Wiserfunding's most recent blog post explores how the ‘multi-search’ feature is revolutionising risk management, and why you can’t afford to [...]

25 January 2024

KUKE selects Wiserfunding to digitise risk assessments

KUKE, Poland’s Export Credit Agency and a leading supplier of trade-facilitating solutions, has selected Wiserfunding, a frontrunner in business credit [...]

3 November 2023

Unlocking new opportunities for SME lending in the GCC

Although the current numbers of SME employees in the GCC may be far below global averages, the ambition is not. [...]

11 October 2023

The role of Capital Markets in supporting SMEs funding in the LAC region

Wiserfunding's most recent blog post discusses our founders most recent study, sponsored by the Inter-American Development Bank, on how capital [...]

4 October 2023

Can capital markets play a vital role in supporting SME financing?

Wiserfunding's most recent blog post discusses the benefits of increasing support for SME funding through capital markets. In the wake [...]

3 October 2023

Risk management 2.0

Balancing human touch and automation ‘The things that make me different are the things that make me, me.’ Immortal words [...]

26 September 2023

Supply Chain Strain

How to tackle turbulence in the supply chain. So far the 2020s has not been the smoothest of rides. We [...]

22 August 2023

Non-Bank Lending During Crises

Julio Prado, Business Analyst at Wiserfunding, provides a summary of the recently published BIS research, highlighting two fundamental findings. The [...]

22 August 2023

The reality of non-bank lenders during a crisis and how data can help

We are excited to announce our partnership with CARDO AI, a Milan-based private debt investment management technology platform. Our partnership [...]

19 July 2023

The Future of Private Credit Markets

The Future of Private Credit Markets Wiserfunding recently organised an event along with our partners at CARDO AI, bringing together lending [...]

23 June 2023

BNPL Affordability for SME Lenders

BNPL Affordability for SME Lenders With Buy Now, Pay Later (BNPL) regulation on the horizon in the UK, the concept of borrower [...]

13 December 2022

Wiserfunding and Cardo AI partner to transform credit analytics in the private debt market

Wiserfunding and Cardo AI partner to transform credit analytics in the private debt market We are excited to announce our [...]

5 December 2022

Wiserfunding and Defyca partner to bring SME debt funding on-chain

At Wiserfunding, our mission is to address the $5.4tn SME (Small and Medium Enterprise) funding gap by empowering lenders [...]

17 October 2022

How LCI improved credit efficiency by 80% using Wiserfunding

How LCI improved credit efficiency by 80% using Wiserfunding Get in touch “Since onboarding Wiserfunding as a management and decision [...]

13 October 2022

Breaking the Bias: Challenges and Solutions

Breaking the Bias: Challenges and Solutions As part of International Women's Day celebrations, Wiserfunding joined a distinguished online panel to [...]

13 July 2022

The Ukrainian banking system during wartime

Since February 2022, Ukraine has been roiled by Putin's hostile military invasion. Despite the heavy humanitarian and financial toll, the [...]

12 July 2022

Resilience is the new normal

How to proactively manage a lending portfolio in uncertain times We analysed a random sample of 1,820 SMEs across multiple [...]

1 June 2022

Champions League Football: Risk, Resilience and Performance

A snapshot of the top clubs in Champions League football With 5 billion fans around the globe, the beautiful game [...]

12 April 2022

Climate Risk and SME Credit Analytics: An Urgent & Emerging Discipline

Climate Risk and SME Credit Analytics: An Urgent & Emerging Discipline Climate and environmental risk analytics are increasingly important drivers [...]

12 April 2022

What We’ve Heard and What We’ve Been Building

What We Have Learned All our clients share a common goal; they need accurate, independent, and reliable insights into SMEs’ credit risk. [...]

12 April 2022

New members of Wiserfunding’s Advisory Board

Wiserfunding welcomes Kathleen Traynor Derose, Patrizio Messina, Joao Douat, Tony Kao and Mark Kronfeld as new members of the Advisory [...]

24 March 2022

Weak business models to blame for the collapse of UK energy providers

This week, we released research into the UK energy sector, which highlighted systemic shortcomings in the assessment of dozens of [...]

11 January 2022

Fintech Solutions to Drive Economic Recovery in the SME Space

As a “nation of shopkeepers,” the United Kingdom is an ideal case study for examples of what businesses need to [...]

17 December 2021

Four Themes and a Notable Absence from Risk Minds 2021

After years of virtual conferences & the looming threat of the omicron variant, we weren't t sure what to expect [...]

26 October 2021

Z-score vs minimum variance preselection methods for constructing small portfolios

Several contributions in the literature argue that a significant in-sample risk reduction can be obtained by investing in a relatively [...]

The Credit Cycle Outlook

The good times are gone. As public markets wrestle with a perfect storm of macroeconomic risks and difficult national and [...]

26 October 2021

Wiserfunding Co-Founder Dr. Edward Altman at the European Parliament

Dr. Edward Altman at the European Parliament explaining the need for an independent market standard to assess SME Credit Risk [...]

26 October 2021

Interview with Gabriele Sabato, CEO and co-founder

Interview with Gabriele Sabato, CEO and co-founder, at RiskMinds in Barcelona 2021 It was great to see the RiskMinds community back together [...]

19 August 2021

The Value of Non-Financial Information in SME Risk Management

The Basel CapitalAccord and the 2007 financial crisis have provided renewed impetus for lenders to research and develop adequate failure [...]

19 August 2021

Edward Altman: Where Are We in the Credit Cycle?

The Covid-19 health crisis has dramatically affected just about every aspect of the economy, including the transition from a record [...]

The Link between Default and Recovery Rates: effects on the procyclicality of regulatory capital ratios

This paper analyses the impact of various assumptions about the association between aggregate default probabilities and the loss given default [...]

19 July 2021

The link between default and recovery rates: effects on the procyclicality of regulatory capital ratios

BIS Working Papers are written by members of the Monetary and Economic Department of the Bank for International Settlements, and [...]

19 July 2021

New rating agency aims to save European SMEs from worst effects of Basel III

In July, Europe’s first certified credit rating agency for small and medium-sized enterprises (SMEs) was launched, holding out the promise that as [...]

Credit Risk Scoring Models

Credit scoring models play a fundamental role in the risk management practice at most banks. They are used to quantify [...]

Measuring and Managing Credit and Other Risks

During the last 40 years, risk management has evolved tremendously. The technologies and methodologies to measure risks have reached impressive [...]

2 June 2021

US heading for 2nd largest bankruptcies: Edward Altman

There is no question that the global economy is now in a financial crisis, perhaps unprecedented in its type and [...]

19 May 2021

Nimbla and Wiserfunding partner to protect UK SMEs from insolvency

With the number of UK SMEs in significant financial distress reaching over 500,000 due to COVID-19[1], leading invoice insurance provider [...]

19 May 2021

New fintech partnership aims to protect SMEs against insolvent customers

This support SMEs to continue trading, especially since the number of UK SMEs in significant financial distress has reached over [...]

19 May 2021

Managing Credit Risk For Retail Low-Default Portfolios

Low-Default Portfolios (LDPs) form a significant and substantial portion of retail assets at major financial institutions. However, in the literature, [...]

19 April 2021

CEO of Wiserfunding comments on Small Business Survey 2018

Dr. Gabriele Sabato, former head of Risk Appetite Portfolio Decisioning at RBS and CEO, co-founder of Wiserfunding, comments on SME lending in conjunction with [...]

19 April 2021

Z-Score Creator Altman Builds Model for Small Business Defaults

Edward Altman, who created the Z-score method for predicting bankruptcies 50 years ago, has built on the model to assess [...]

Estimating Conservative Loss Given Default

The new Basel Capital Accord (Basel II) is going to be embedded in the risk management practices at many financial [...]

20 March 2021

Father of Z-Scores Discusses Virus Impact on Corporate America

Edward Altman, professor emeritus of finance at New York University Stern School of Business, who is known for his pioneering [...]

11 January 2021

Mastering Risk Management in the Digital Payments Space

Merchant acquirers are faced with a challenging environment and will have to face further risks. The credit risk process needs [...]

13 September 2020

Risk Management, Corporate Governance, and Bank Performance in the Financial Crisis

The recent financial crisis has raised several questions with respect to the corporate governance of financial institutions. This paper investigates [...]

13 September 2020

Modeling Credit Risk For SMEs : Evidence From The US Market

Considering the fundamental role played by small and medium sized enterprises (SMEs) in the economy of many countries and the [...]

13 September 2020

Financial Crisis: Where Did Risk Management Fail?

The real estate market bubble and the subprime mortgages have been often identified as the causes of the current financial [...]

13 September 2020

Assessing the Credit Worthiness of Italian SMEs and Mini-bond Issuers

Abstract A number of innovations have been introduced in the last five years to counter the devastating impact of credit [...]

13 September 2020

Nimbla Teams With Wiserfunding To Safeguard Invoices

U.K. invoice insurance provider Nimbla is teaming up with the credit risk assessment firm Wiserfunding, according to a report in Crowdfund Insider on Friday (May [...]