Recent changes in market expectations, particularly regarding a potential interest rate cut by the Bank of England, prompt lenders to reassess their strategies. Traders estimate a 35% likelihood of a 0.25 percentage point reduction, alongside increasing anticipation of actions from the US Federal Reserve. How to predict all the risks in this turbulent landscape?

While financial data remains valuable, it can also be misleading. For instance, relying solely on historical default rates might suggest low risk in a particular industry, but unstructured data from news and social media can reveal rising consumer concerns.

As market conditions evolve rapidly, traditional data sources may lag in reflecting real-time borrower sentiment. In contrast, unstructured data, which comprises about 80% of enterprise data, offers timely insights, empowering lenders to swiftly adjust their strategies and avoid risks.

Unlocking Core Data

Structured financial data—such as revenue, profit, and cash flows—has traditionally dominated risk assessment, while unstructured data is often overlooked due to its perceived complexity and lack of standardisation. However, by utilising all available data sources, lenders can ultimately maximise the value of their practices.

Unstructured data holds core insights that extend beyond conventional metrics. Key areas of focus include:

- Public Records: Court documents and bankruptcy filings reveal crucial risk indicators, increasing an applicant’s risk profile by 20%. They can also identify fraudulent patterns, flagging high-risk applicants early.

- Legal Events: Monitoring lawsuits or regulatory actions uncovers additional risks and indicates underlying issues that may affect a company’s financial stability.

- Press and Social Media: Insights from news and social media provide context on a company’s reputation, with negative sentiment serving as early warning signs of potential financial distress.

Let’s delve into two more critical areas to consider when evaluating borrowers—areas that warrant special attention.

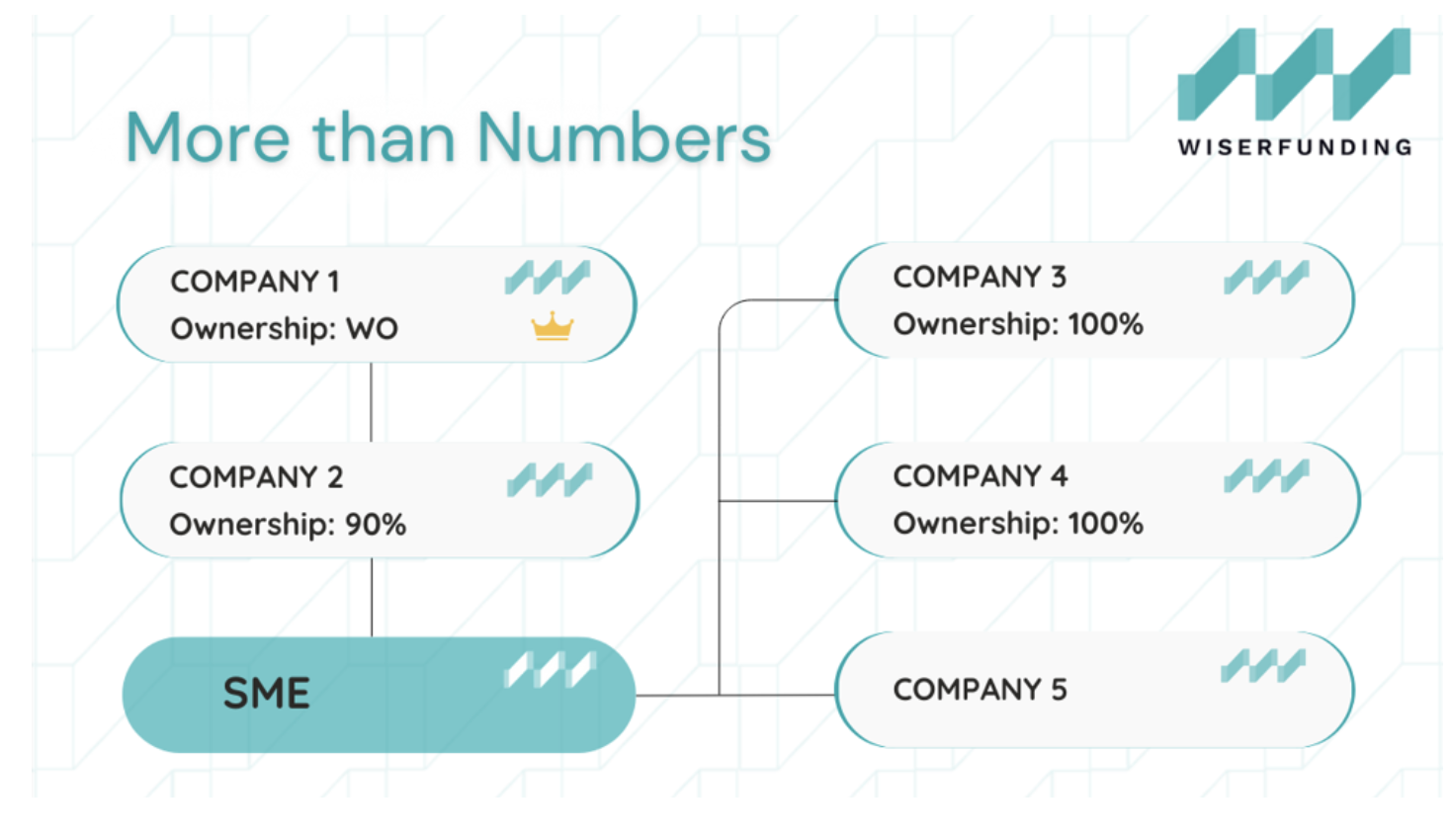

The Architecture of Accountability: Ownership Structure and Governance

How well do you understand the ownership structure and corporate governance of your borrowing companies? Grasping these factors is critical, as studies indicate that shareholder ownership percentages can significantly influence credit risk. Research on Vietnamese commercial banks has shown a strong correlation between foreign ownership and equity ratios with credit risk outcomes. Additionally, understanding ownership structures can greatly assist you in navigating the complexities of sanctioned countries and manage risks associated with potential borrowers in these regions.

When foreign-owned banks increase equity capital, their credit risk typically decreases more than that of state-owned banks. Moreover, separating ownership from management can create conflicts of interest that affect decision-making and credit risk. Implementing effective governance structures can mitigate these risks, ensuring lending practices are informed and aligned with broader economic conditions.

You might now be wondering: how can I integrate this data into my assessments, and what resources will it take? This is a valid concern—let’s explore the options available to lenders today.

Tools to Reveal the Data Gems

Finance is undergoing a significant transformation due to automation and AI. Innovative advancements are streamlining operations: entity recognition cuts application processing time by 30%, enhancing efficiency, while automated sentiment analysis improves risk model accuracy by 12% by assessing borrower sentiment across various channels. Additionally, machine learning reveals hidden patterns in transaction data, allowing lenders to identify borrowers at risk of default more effectively.

Wiserfunding Approach

Alongside the diverse financial data we’ve collected with the guidance of @Edward Altman, our co-founder and Finance Professor with over 50 years of credit risk analysis experience, we have consistently prioritised non-financial data. Our platform harnesses AI and machine learning technologies, converting processes that once required months of meticulous effort into a simple button click.

Today, our platform provides insights into corporate governance, legal events, press and social media, while also identifying potential risks through alerts. We utilise diverse data from non-financial sources like Google, LinkedIn, Boardex, and more.

By automating data sourcing and processing, we ensure operational efficiency and clarity in model results. Our clients consistently highlight the benefits of enhanced visibility into internal processes, leading to more informed, quicker and confident decision-making*.

Harvest the Insights

Let’s summarise what advantages unstructured data incorporation provides.

- Enhanced Borrower Profiling: A comprehensive view of applicants may increase loan approvals for underserved populations by 15%

- Identifying Hidden Risks: Unstructured data can reveal potential red flags that structured data might overlook, such as risky spending behaviours

- Expanding Access to Credit: By considering a wider array of data points, lenders can improve credit access for individuals lacking traditional credit histories

- Improving Model Accuracy: Enriching risk assessments with diverse data sources can potentially reduce loan defaults by 10%, positively impacting overall financial performance

- Strengthening Fraud Detection: Unstructured data can enhance the identification of fraudulent activities by highlighting unusual patterns and anomalies in borrower behaviour.

Keep Digging Deeper

To discover how unstructured data can elevate your credit risk assessment strategies, we offer a demo of our platform.

Feel free to request your free trial and receive a guided walkthrough of our data capabilities

SOURCES:

The Guardian: UK savers urged to find better deals after several banks cut interest rates

The Financial Times: Markets price in 35% chance of central bank move this week as expectations of large US rate cut have grown

Forbes: Businesses Have Invested Deeply In Data, But They’re Still Just Scratching The Surface

Ho The Tran: Foreign Ownership and Bank Risk-taking in Vietnam

SIMILAR POSTS

Key Credit Risks From the IMF’s Global Financial Stability Report

Lending Into Fragility: Key Risks From the IMF’s Global Financial Stability Report For lenders navigating deteriorating credit conditions, the IMF’s [...]

12 March 2025

Stock Sell-Off Leads to Nasdaq’s Worst Day Since 2022

Are Credit Markets Signaling Trouble? Insights from Professor Edward Altman on Systemic Risks and Defaults in His Bloomberg Interview. [...]

Wiserfunding Attends Private Credit Connect in London 2025

We are excited to announce that Wiserfunding will attend Private Credit Connect London on March 26th. This exclusive event [...]