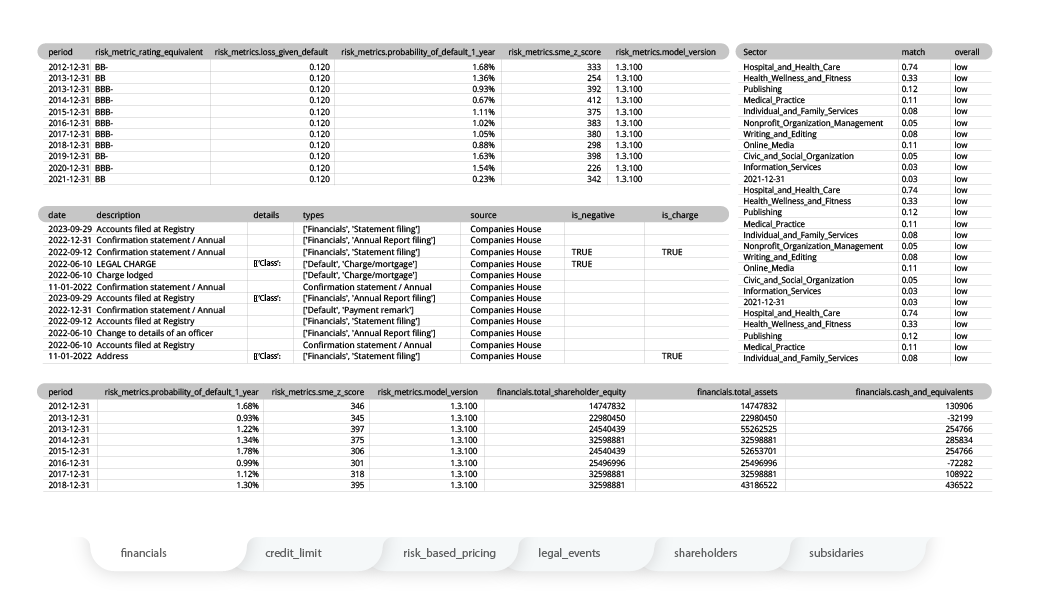

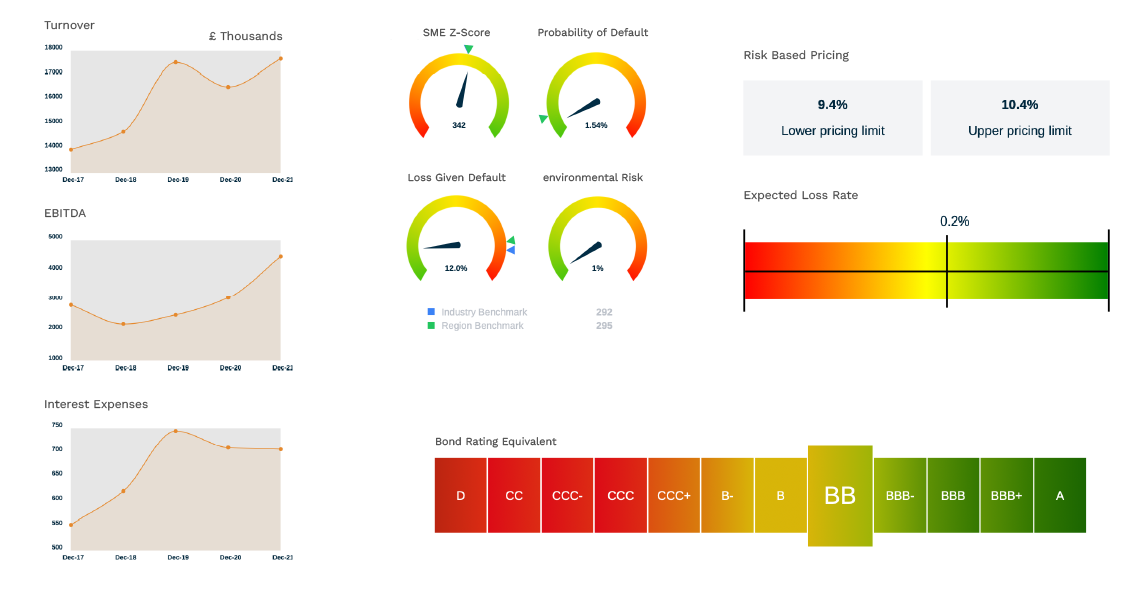

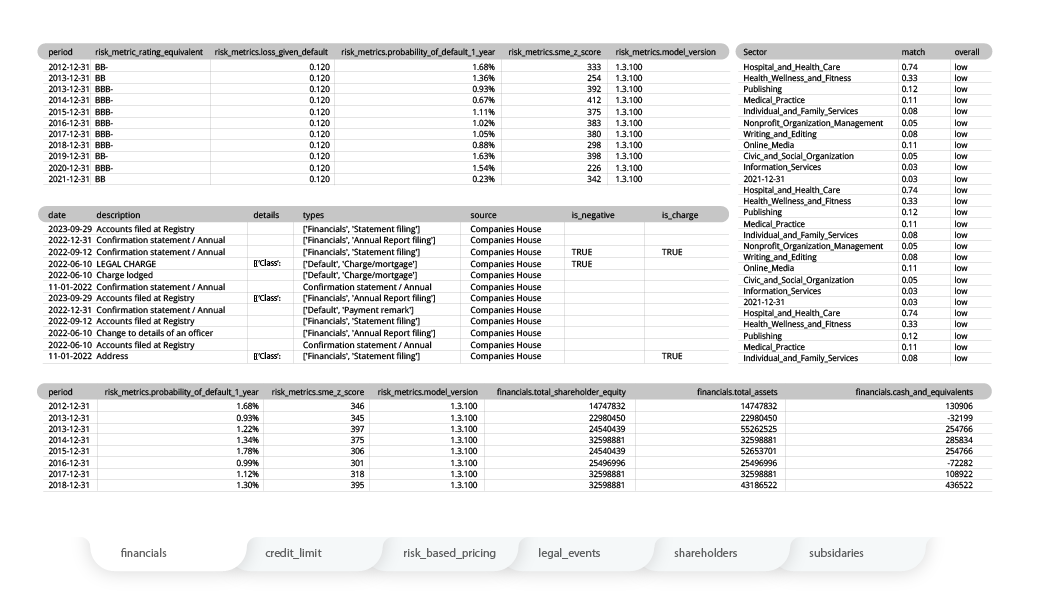

Comprehensive

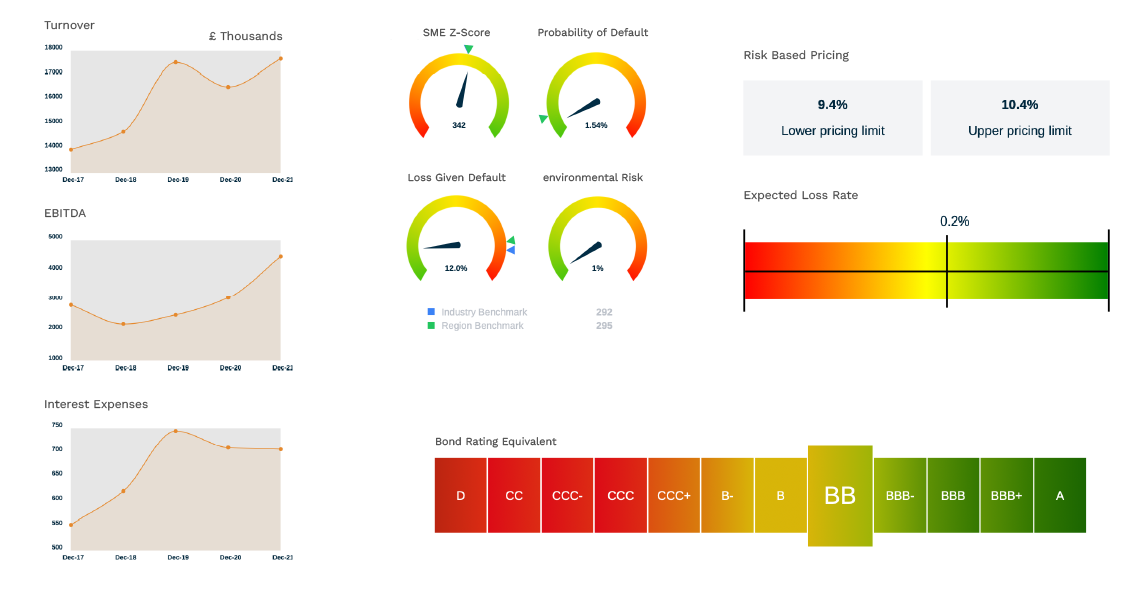

Credit Risk Assessment

at your fingertips

Leveraging 70+ years of expertise and advanced technologies, we help lenders excel at boosting portfolio performance.

Connect with us to elevate your efficiency!

Smart Automation for Confident Lending Decisions

Smart Automation for Confident Lending Decisions

Save your time for what matters

Save your time for what matters

Trusted by Industry Leaders

Trusted by Industry Leaders

«Bringing in Wiserfunding’s independent and seasoned view helped us triangulate risk assessments, validate our thinking, and ultimately strengthen our confidence in the portfolio.

Having that third lens — objective, data-driven, and methodologically distinct — was of tremendous value to us.»

— Julian S. Schickel, Co-founder, Avellinia Private Capital

«Bringing in Wiserfunding’s independent and seasoned view helped us triangulate risk assessments, validate our thinking, and ultimately strengthen our confidence in the portfolio.

Having that third lens — objective, data-driven, and methodologically distinct — was of tremendous value to us.»

— Julian S. Schickel, Co-founder, Avellinia Private Capital

«Wiserfunding provides crucial third-party validation that helps us bypass the limitations of traditional rating agencies. These agencies often start with low ratings for smaller companies, assuming they are more vulnerable. Wiserfunding, however, enables us to demonstrate that while our borrowers may be smaller, they are not weaker. By combining our own data with Wiserfunding’s insights, we can clearly showcase the strength and potential of these businesses, allowing us to make better, more informed decisions in our underwriting process.»

— Michael McAdams, CEO of Pasadena Private Lending

«Wiserfunding provides crucial third-party validation that helps us bypass the limitations of traditional rating agencies. These agencies often start with low ratings for smaller companies, assuming they are more vulnerable. Wiserfunding, however, enables us to demonstrate that while our borrowers may be smaller, they are not weaker. By combining our own data with Wiserfunding’s insights, we can clearly showcase the strength and potential of these businesses, allowing us to make better, more informed decisions in our underwriting process.»

— Michael McAdams, CEO of Pasadena Private Lending

«Wiserfunding allows us to evaluate businesses based on growth potential, not just historical data.»

«As Wiserfunding starts to ingest real-time company performance, updating SME Z-score/BER, we are confident this will help our desire to support our clients growth ambitions.»

«Wiserfunding worked with us to build tailored LGD risk models so our risk function could easily become compliant , with new FCA regulations.»

«Wiserfunding allows us to evaluate businesses based on growth potential, not just historical data.»

«As Wiserfunding starts to ingest real-time company performance, updating SME Z-score/BER, we are confident this will help our desire to support our clients growth ambitions.»

«Wiserfunding worked with us to build tailored LGD risk models so our risk function could easily become compliant , with new FCA regulations.»