Several contributions in the literature argue that a significant in-sample risk reduction can be obtained by investing in a relatively small number of assets in an investment universe. Furthermore, selecting small portfolios seems to yield good out-of-sample performances in practice. This analysis provides further evidence that an appropriate preselection of the assets in a market can lead to an improvement in portfolio performance.

SIMILAR POSTS

Credit Risk Scoring Models

Credit scoring models play a fundamental role in the risk management practice at most banks. They are used to quantify [...]

Measuring and Managing Credit and Other Risks

During the last 40 years, risk management has evolved tremendously. The technologies and methodologies to measure risks have reached impressive [...]

2 June 2021

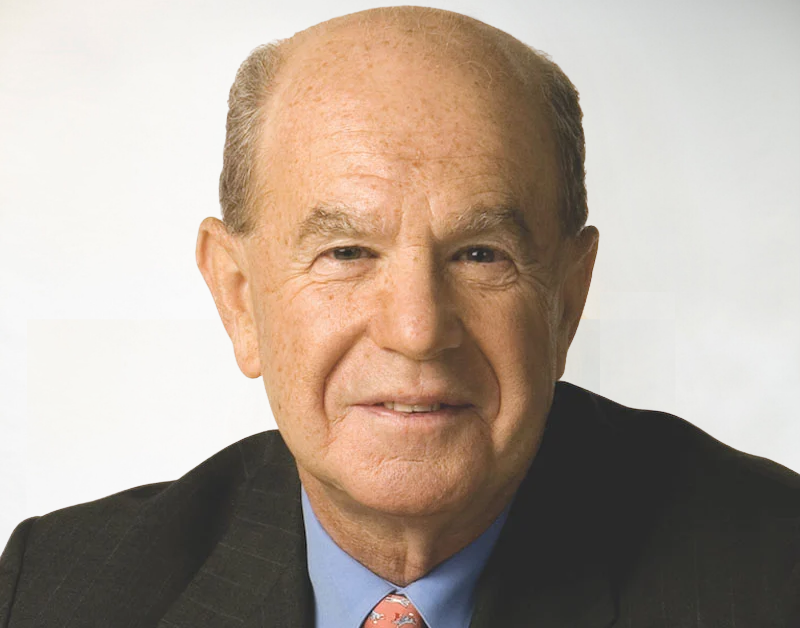

US heading for 2nd largest bankruptcies: Edward Altman

There is no question that the global economy is now in a financial crisis, perhaps unprecedented in its type and [...]