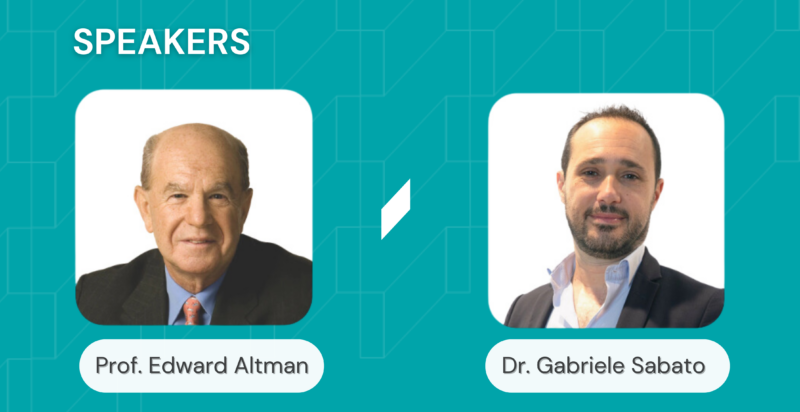

On September 11th, we hosted an insightful webinar on

How Global Uncertainty

is Affecting the Credit Cycle

Here are the key takeaways that left us thinking:

• The status of the credit cycle can be a leading indicator to the business cycle – specifically it looks like we are heading towards a recession where default rates will increased to a Stressed stage of the Credit Cycle

• Chapter 11 bankruptcies in the US have reached their highest level in recent memory in the first eight months of this year. Additionally, UK data shows a rise in business bankruptcies as well

• Wiserfunding uses more than financial data to enable a fuller picture for our risk modelling. Our Portfolio product automates a portfolio view of credit risk intelligence to support identifying key risk companies

Want the full picture?

Download the webinar recording and PDF materials

by filling out the form below!

SIMILAR POSTS

12 April 2022

What We’ve Heard and What We’ve Been Building

What We Have Learned All our clients share a common goal; they need accurate, independent, and reliable insights into SMEs’ credit risk. [...]

12 April 2022

New members of Wiserfunding’s Advisory Board

Wiserfunding welcomes Kathleen Traynor Derose, Patrizio Messina, Joao Douat, Tony Kao and Mark Kronfeld as new members of the Advisory [...]

24 March 2022

Weak business models to blame for the collapse of UK energy providers

This week, we released research into the UK energy sector, which highlighted systemic shortcomings in the assessment of dozens of [...]