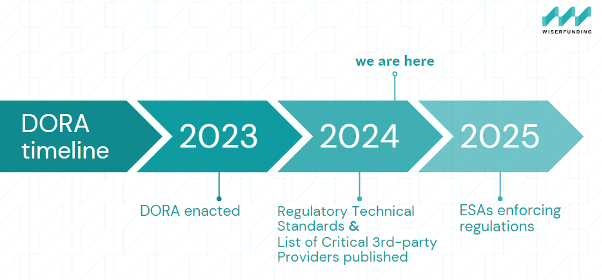

The Digital Operational Resilience Act (DORA) is a critical initiative aimed at enhancing the operational resilience of the financial sector in the European Union. Officially effective as of January 16, 2023, with full applicability set for January 17, 2025, DORA establishes a comprehensive framework that mandates financial entities to strengthen their capacity to withstand and recover from significant operational disruptions.

DORA harmonises regulations across the EU, applying to financial entities and their ICT providers, ensuring uniform operational resilience. This is especially crucial for the entities operating across multiple jurisdictions to maintain economic stability.

Key Provisions of DORA

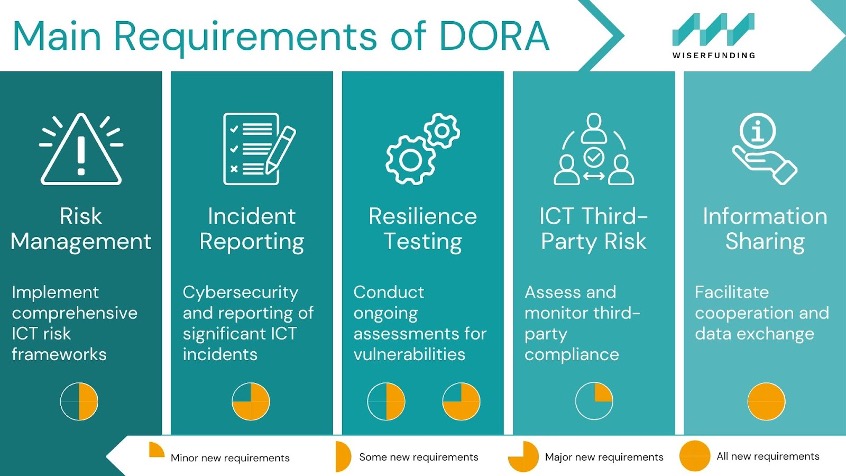

DORA includes several key provisions tailored for private credit lenders, banks, and ECAs to enhance their operational resilience:

Potential Impacts of DORA on Financial Organizations:

Structured Approach: Financial institutions are required to adopt a comprehensive methodology that encompasses risk assessment, incident reporting, and third-party risk management. This structured approach ensures that all aspects of operational resilience are systematically addressed.

Shift to Proactiveness: Organizations will need to transition from reactive to proactive risk management and resilience building. This shift enables institutions to better prepare for potential disruptions before they occur.

Increased Oversight: DORA mandates transparency and rigorous documentation to ensure compliance with regulatory standards. Increased oversight fosters accountability and trust among stakeholders.

Monitoring CTPPs: DORA’s oversight framework for Critical Third-party Providers empowers the European Supervisory Authorities (ESAs)—EBA, ESMA, and EIOPA—to closely monitor key ICT providers. These authorities have the ability to request compliance information, conduct inspections, impose penalties, and issue recommendations, ensuring that CTPPs adhere to DORA’s requirements.

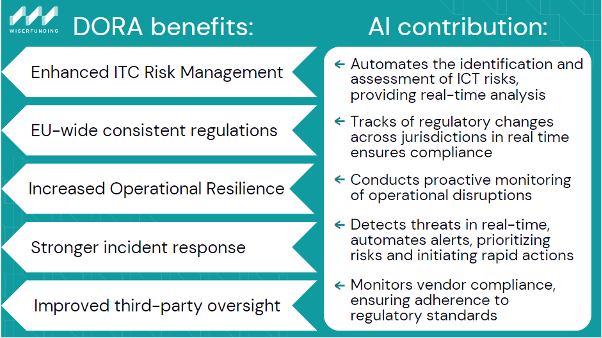

Unlocking Operational Resilience: AI and DORA Compliance Synergy

Compliance with DORA aligns seamlessly with the capabilities of AI technology. By leveraging AI and understanding DORA’s implications, financial institutions can strengthen their operational resilience. Embracing up-to-date technologies is key to thriving in the modern financial landscape.

Charting the Path Forward

As financial entities gear up for DORA’s full implementation in 2025, grasping its framework is vital. By adopting strong governance practices and complying with DORA, they can enhance their resilience in a complex digital landscape, safeguarding operations and supporting the stability of the EU financial ecosystem.

References:

– DORA

SIMILAR POSTS

19 May 2021

New fintech partnership aims to protect SMEs against insolvent customers

This support SMEs to continue trading, especially since the number of UK SMEs in significant financial distress has reached over [...]

19 May 2021

Managing Credit Risk For Retail Low-Default Portfolios

Low-Default Portfolios (LDPs) form a significant and substantial portion of retail assets at major financial institutions. However, in the literature, [...]

19 April 2021

CEO of Wiserfunding comments on Small Business Survey 2018

Dr. Gabriele Sabato, former head of Risk Appetite Portfolio Decisioning at RBS and CEO, co-founder of Wiserfunding, comments on SME lending in conjunction with [...]