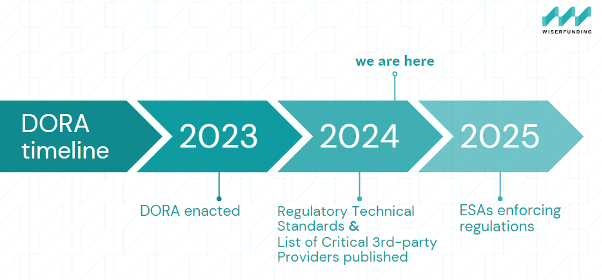

The Digital Operational Resilience Act (DORA) is a critical initiative aimed at enhancing the operational resilience of the financial sector in the European Union. Officially effective as of January 16, 2023, with full applicability set for January 17, 2025, DORA establishes a comprehensive framework that mandates financial entities to strengthen their capacity to withstand and recover from significant operational disruptions.

DORA harmonises regulations across the EU, applying to financial entities and their ICT providers, ensuring uniform operational resilience. This is especially crucial for the entities operating across multiple jurisdictions to maintain economic stability.

Key Provisions of DORA

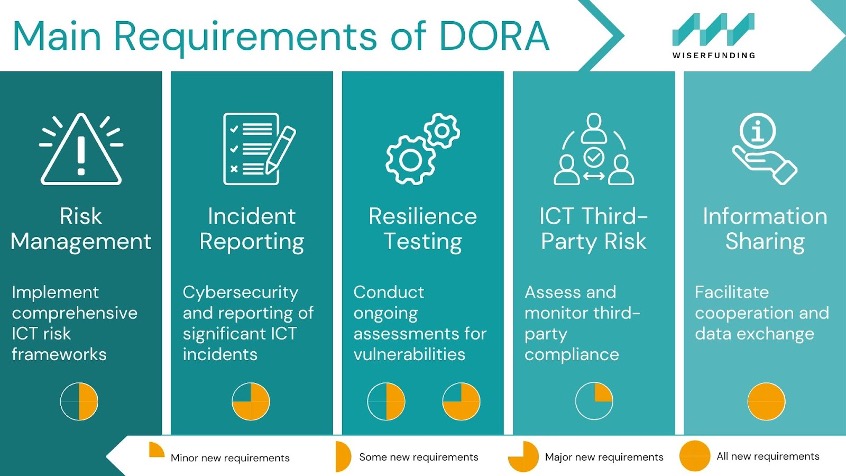

DORA includes several key provisions tailored for private credit lenders, banks, and ECAs to enhance their operational resilience:

Potential Impacts of DORA on Financial Organizations:

Structured Approach: Financial institutions are required to adopt a comprehensive methodology that encompasses risk assessment, incident reporting, and third-party risk management. This structured approach ensures that all aspects of operational resilience are systematically addressed.

Shift to Proactiveness: Organizations will need to transition from reactive to proactive risk management and resilience building. This shift enables institutions to better prepare for potential disruptions before they occur.

Increased Oversight: DORA mandates transparency and rigorous documentation to ensure compliance with regulatory standards. Increased oversight fosters accountability and trust among stakeholders.

Monitoring CTPPs: DORA’s oversight framework for Critical Third-party Providers empowers the European Supervisory Authorities (ESAs)—EBA, ESMA, and EIOPA—to closely monitor key ICT providers. These authorities have the ability to request compliance information, conduct inspections, impose penalties, and issue recommendations, ensuring that CTPPs adhere to DORA’s requirements.

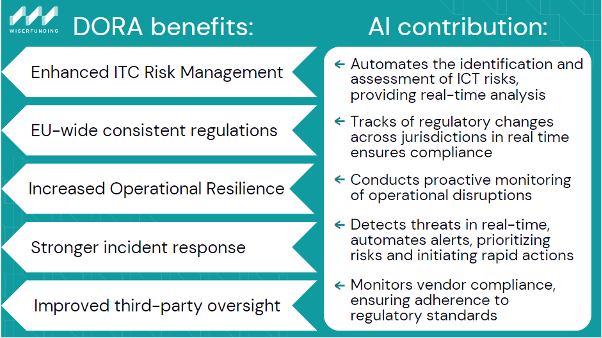

Unlocking Operational Resilience: AI and DORA Compliance Synergy

Compliance with DORA aligns seamlessly with the capabilities of AI technology. By leveraging AI and understanding DORA’s implications, financial institutions can strengthen their operational resilience. Embracing up-to-date technologies is key to thriving in the modern financial landscape.

Charting the Path Forward

As financial entities gear up for DORA’s full implementation in 2025, grasping its framework is vital. By adopting strong governance practices and complying with DORA, they can enhance their resilience in a complex digital landscape, safeguarding operations and supporting the stability of the EU financial ecosystem.

References:

– DORA

SIMILAR POSTS

12 April 2022

What We’ve Heard and What We’ve Been Building

What We Have Learned All our clients share a common goal; they need accurate, independent, and reliable insights into SMEs’ credit risk. [...]

12 April 2022

New members of Wiserfunding’s Advisory Board

Wiserfunding welcomes Kathleen Traynor Derose, Patrizio Messina, Joao Douat, Tony Kao and Mark Kronfeld as new members of the Advisory [...]

24 March 2022

Weak business models to blame for the collapse of UK energy providers

This week, we released research into the UK energy sector, which highlighted systemic shortcomings in the assessment of dozens of [...]