This paper analyses the impact of various assumptions about the association between aggregate default probabilities and the loss given default on bank loans and corporate bonds, and seeks to empirically explain this critical relationship. Moreover, it simulates the effects of this relationship on the procyclicality of mandatory capital requirements like those proposed in 2001 by the Basel Committee on Banking Supervision. We present the analysis and results in four distinct sections.

SIMILAR POSTS

Credit Risk Scoring Models

Credit scoring models play a fundamental role in the risk management practice at most banks. They are used to quantify [...]

Measuring and Managing Credit and Other Risks

During the last 40 years, risk management has evolved tremendously. The technologies and methodologies to measure risks have reached impressive [...]

2 June 2021

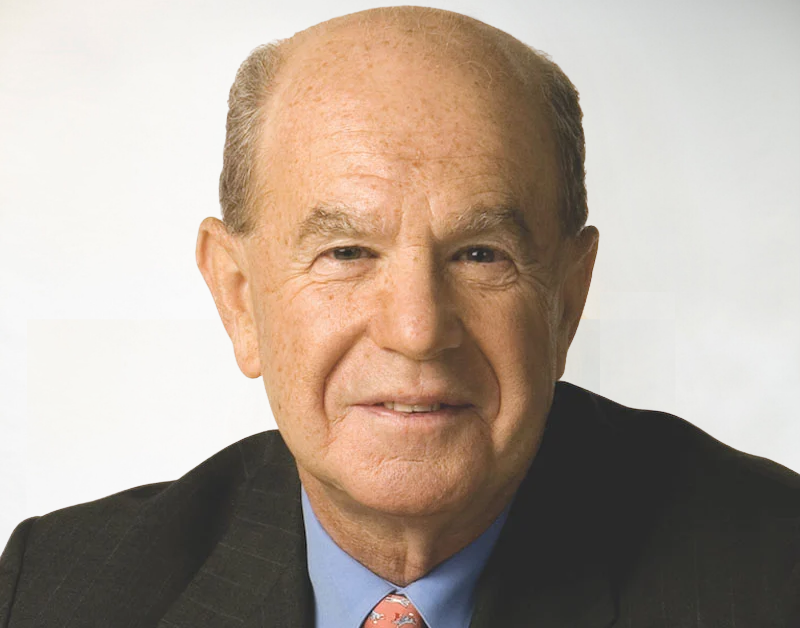

US heading for 2nd largest bankruptcies: Edward Altman

There is no question that the global economy is now in a financial crisis, perhaps unprecedented in its type and [...]