Advanced technology

driving a paradigm shift

in SME risk analysis

Advanced technology driving a paradigm shift in SME risk analysis

Explore the cutting-edge AI and machine learning powering our solutions

Explore the cutting-edge AI and machine learning powering our solutions

OUR TECHNOLOGY

Advanced technology

driving a paradigm

shift in SME risk

analysis

Explore the cutting-edge AI and machine learning powering our solutions

Empowering financial

decisions

with advanced AI

Empowering financial

decisions with

advanced AI

At Wiserfunding, our advanced algorithms swiftly process vast data, both structured and unstructured, delivering unparalleled speed and precision. With lenders benefiting from advanced insights, we’re helping lead credit risk analysis within the evolving financial landscape.

At Wiserfunding, our advanced algorithms swiftly process vast data, both structured and unstructured, delivering unparalleled speed and precision. With lenders benefiting from advanced insights, we’re helping lead credit risk analysis within the evolving financial landscape.

The building blocks of our platform

Our machine learning technology goes beyond traditional NACE codes, analysing company websites for a holistic understanding of business operations. This streamlines manual verification, ensuring an unbiased, error-free process. This enhances accuracy in matching you with appropriate lending options.

Our platform uses AI-powered ETL (Extract, Transform, Load) to process API-collected data. This progressive system skilfully extracts and transforms information into specific variables for our models, ensuring tailored insights. Integrating AI in our ETL enhances the precision and reliability of our risk assessment tools.

Wiserfunding holds SOC2 and ISO27001 certifications, affirming our commitment to the highest standards of security and data management. These certifications represent our dedication to safeguarding sensitive data and maintaining client trust in an industry where security is indispensable.

Our technology in action

Case Study

A Regional Bank Enhances Screening and Origination with Wiserfunding

Background:

A regional bank serving the SME sector wanted to speed up their loan origination process while reducing the risk of bad debts. The bank was using a traditional credit scoring model that failed to capture the complex landscape of SME risk.

Implementation:

The bank implemented Wiserfunding for its advanced predictive analytics and immediate access to an intuitive platform. Within just one hour, the team was trained and started screening potential loan applicants using Wiserfunding's sophisticated AI-driven algorithms.

Results:

Time-to-decision

was cut down by 40%.

Accuracy in identifying high-risk applicants improved by 25%.

Loan origination costs reduced by 15% due to the efficiency of the system.

Case Study

A national bank revolutionises underwriting with Wiserfunding

Background:

A national bank was seeking to improve its underwriting process for SME loans. Their existing systems were causing delays and lacked predictive capabilities.

Implementation:

The bank used Wiserfunding's API to integrate its advanced analytics into their existing underwriting workflow. Integration was completed within three hours, and the underwriting team started using the platform immediately.

Results:

Non-performing loans saw a reduction of 20% in the first quarter.

Time spent on underwriting tasks Time spent on underwriting tasks reduced by 30% due to predictive analytics and insights.

Loan profitability improved as better risk assessment led to more accurate pricing.

Case Study

A UK bank optimises portfolio management with Wiserfunding

Background:

A multinational bank was struggling with portfolio management for its SME loans. They faced challenges in identifying emerging risks and taking timely action.

Implementation:

The bank incorporated Wiserfunding's portfolio management solution, leveraging its native integrations with other banking platforms they were already using. A dedicated customer success manager from Wiserfunding ensured smooth implementation.

Results:

Early warning indicators

helped proactively manage risks, reducing potential losses by 10% in the first six months.

Time spent on portfolio analysis was cut in half, allowing for more strategic activities.

Compliance and reporting became more straightforward due to the advanced analytics, reducing manual work and chances of error.

Case Study

An SME Bank Achieves Unprecedented Operational Efficiency with Wiserfunding

Background:

A community-focused bank was grappling with operational bottlenecks in its credit risk management workflow. The bank was heavily reliant on manual processes to collect and analyse credit data, leading to high staff workload and prolonged decision times.

Implementation:

Recognising the need for efficiency, the bank chose Wiserfunding for its cutting-edge technology and ability to integrate seamlessly into their existing systems. With the API integrated in just three hours and staff trained within one hour, the platform was ready for action.

Results:

Instant Data Collection and Analysis: As soon as Wiserfunding was implemented, data collection and analysis that previously took hours, if not days, was executed in a matter of seconds. This was made possible by Wiserfunding's state-of-the-art analytics and AI capabilities.

Staff Reallocated to Value-Added Tasks: Freed from the tedium of manual data collection and basic analysis, staff members were reallocated to more value-added tasks such as customer engagement, strategic planning, and complex risk assessment.

Higher Job Satisfaction: As the staff shifted to more meaningful work, the bank experienced a rise in employee satisfaction scores, resulting in lower turnover and higher productivity.

Boost in Overall Efficiency: By automating the routine but essential process of data collection and preliminary analysis, the bank achieved an overall operational efficiency gain of 35%, a figure that surpassed their initial goals for the project..

Case Study

A Regional Bank Enhances Screening and Origination with Wiserfunding

Background:

A regional bank serving the SME sector wanted to speed up their loan origination process while reducing the risk of bad debts. The bank was using a traditional credit scoring model that failed to capture the complex landscape of SME risk.

Implementation:

The bank implemented Wiserfunding for its advanced predictive analytics and immediate access to an intuitive platform. Within just one hour, the team was trained and started screening potential loan applicants using Wiserfunding's sophisticated AI-driven algorithms.

Results:

Time-to-decision

was cut down by 40%.

Accuracy in identifying high-risk applicants improved by 25%.

Loan origination costs reduced by 15% due to the efficiency of the system.

Case Study

A national bank revolutionises underwriting with Wiserfunding

Background:

A national bank was seeking to improve its underwriting process for SME loans. Their existing systems were causing delays and lacked predictive capabilities.

Implementation:

The bank used Wiserfunding's API to integrate its advanced analytics into their existing underwriting workflow. Integration was completed within three hours, and the underwriting team started using the platform immediately.

Results:

Non-performing loans saw a reduction of 20% in the first quarter.

Time spent on underwriting tasks Time spent on underwriting tasks reduced by 30% due to predictive analytics and insights.

Loan profitability improved as better risk assessment led to more accurate pricing.

Case Study

A UK bank optimises portfolio management with Wiserfunding

Background:

A multinational bank was struggling with portfolio management for its SME loans. They faced challenges in identifying emerging risks and taking timely action.

Implementation:

The bank incorporated Wiserfunding's portfolio management solution, leveraging its native integrations with other banking platforms they were already using. A dedicated customer success manager from Wiserfunding ensured smooth implementation.

Results:

Early warning indicators

helped proactively manage risks, reducing potential losses by 10% in the first six months.

Time spent on portfolio analysis was cut in half, allowing for more strategic activities.

Compliance and reporting became more straightforward due to the advanced analytics, reducing manual work and chances of error.

Case Study

An SME Bank Achieves Unprecedented Operational Efficiency with Wiserfunding

Background:

A community-focused bank was grappling with operational bottlenecks in its credit risk management workflow. The bank was heavily reliant on manual processes to collect and analyse credit data, leading to high staff workload and prolonged decision times.

Implementation:

Recognising the need for efficiency, the bank chose Wiserfunding for its cutting-edge technology and ability to integrate seamlessly into their existing systems. With the API integrated in just three hours and staff trained within one hour, the platform was ready for action.

Results:

Instant Data Collection and Analysis: As soon as Wiserfunding was implemented, data collection and analysis that previously took hours, if not days, was executed in a matter of seconds. This was made possible by Wiserfunding's state-of-the-art analytics and AI capabilities.

Staff Reallocated to Value-Added Tasks: Freed from the tedium of manual data collection and basic analysis, staff members were reallocated to more value-added tasks such as customer engagement, strategic planning, and complex risk assessment.

Higher Job Satisfaction: As the staff shifted to more meaningful work, the bank experienced a rise in employee satisfaction scores, resulting in lower turnover and higher productivity.

Boost in Overall Efficiency: By automating the routine but essential process of data collection and preliminary analysis, the bank achieved an overall operational efficiency gain of 35%, a figure that surpassed their initial goals for the project..

Transforming global financial analysis

«Wiserfunding allows us to evaluate businesses based on growth potential, not just historical data.»

«As Wiserfunding starts to ingest real-time company performance, updating SME Z-score/BER, we are confident this will help our desire to support our clients growth ambitions.»

«Wiserfunding worked with us to build tailored LGD risk models so our risk function could easily become compliant , with new FCA regulations.»

Our technology is always one step ahead

Wiserfunding leads in credit risk analysis, continuously advancing through rigorous R&D.

We stay ahead of trends, adapting our platform for SME lenders with regular updates,

new features and improvements. Our commitment to progress ensures clients access

the most advanced, user-friendly and secure tools in SME lending.

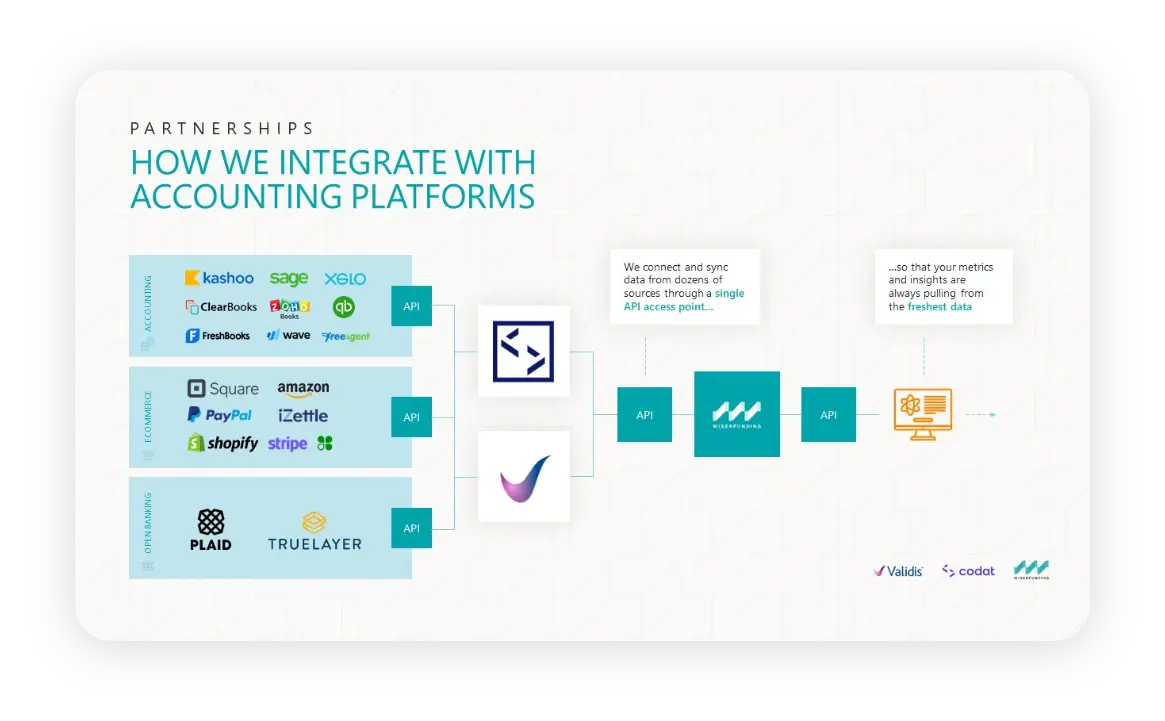

Seamlessly integrating with your systems

Exceptional API documentation:

Streamlined integration into

diverse systems.

Comprehensive and user-friendly:

Straightforward integration for effortless utilisation.

Advanced credit risk tools:

Empowering clients, from tech

experts to API novices.

Clear guidelines: Hassle-free process for seamless platform connection.

Robust support: Expert assistance throughout, ensuring a smooth integration experience.

Cutting-edge capabilities: Enhance your systems with Wiserfunding.