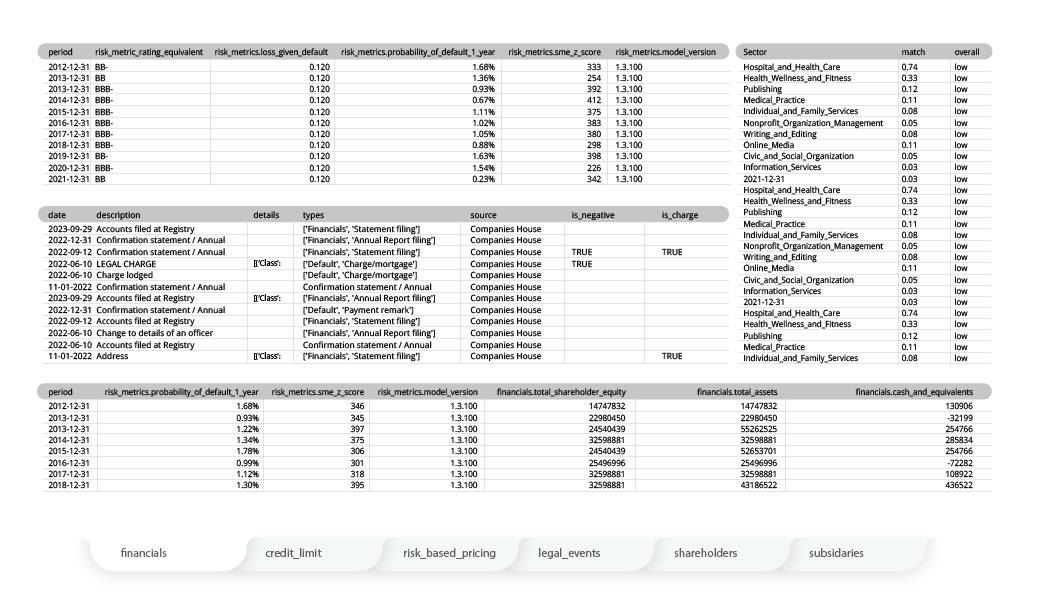

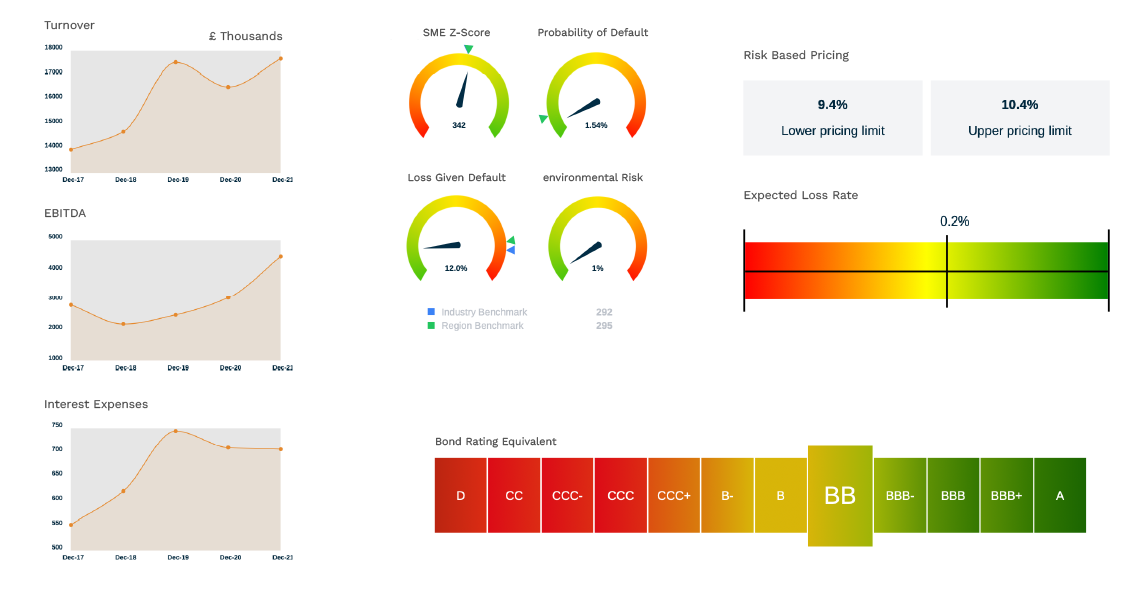

Get Full Visibility Into Client & Supplier Credit Exposure

Get Full Visibility Into Client & Supplier Credit Exposure

Get Full Visibility Into Client & Supplier Credit Exposure

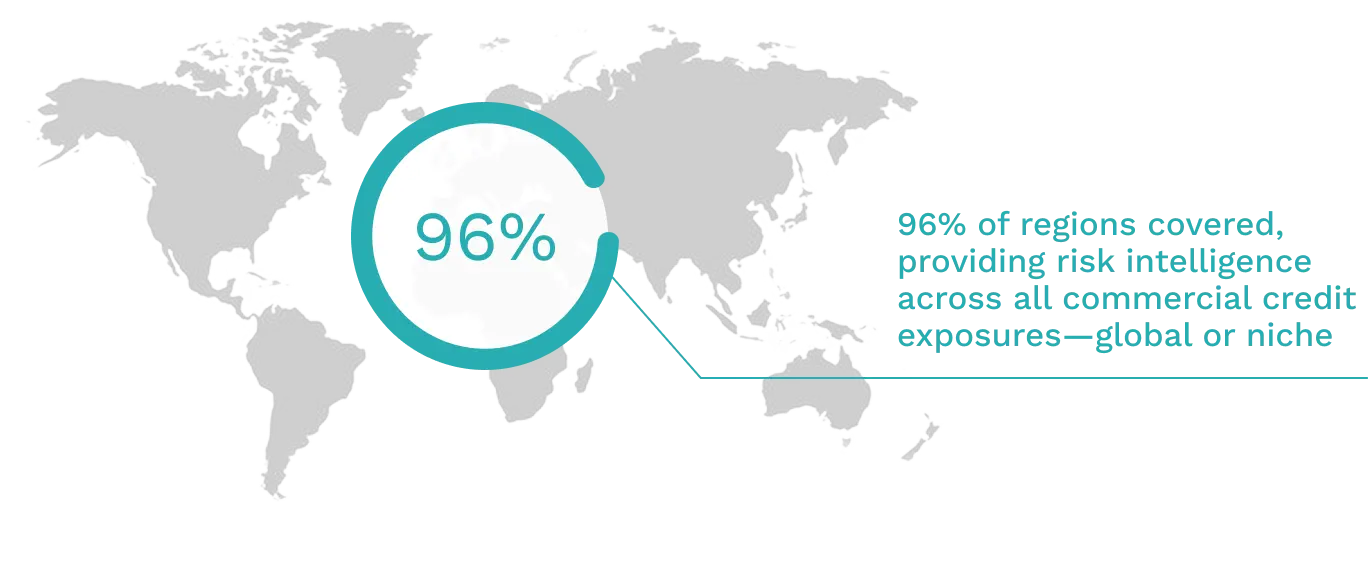

Anywhere, Anytime: Global Credit Risk Support

Anywhere, Anytime: Global Credit Risk Support

Anywhere, Anytime: Global Credit Risk Support

WISER INSIGHTS FOR CREDIT DECISION-MAKERS

«Wiserfunding allows us to evaluate businesses based on growth potential, not just historical data.»

«As Wiserfunding starts to ingest real-time company performance, updating SME Z-score/BER, we are confident this will help our desire to support our clients growth ambitions.»

«Wiserfunding worked with us to build tailored LGD risk models so our risk function could easily become compliant , with new FCA regulations.»

«Wiserfunding allows us to evaluate businesses based on growth potential, not just historical data.»

«As Wiserfunding starts to ingest real-time company performance, updating SME Z-score/BER, we are confident this will help our desire to support our clients growth ambitions.»

«Wiserfunding worked with us to build tailored LGD risk models so our risk function could easily become compliant , with new FCA regulations.»