Tailored to Your Needs

Adapting to your

unique requirements

Our platform delivers unmatched flexibility – choose between our ready-to-deploy solution for immediate results, or customise every component to your exact specifications. The standard version provides a proven, battle-tested foundation covering 90% of use cases, while our configurable architecture lets you adapt scoring models, workflows, and reporting to your unique risk appetite and business processes.

Our platform offers exceptional versatility with both an out-of-the-box solution and the option for extensive customisation. Our standard solution is a robust, ready-to-use tool, meeting most client requirements. But the ability to configure the features means you can tailor the solution to your unique needs.

Empowering Industry Leaders

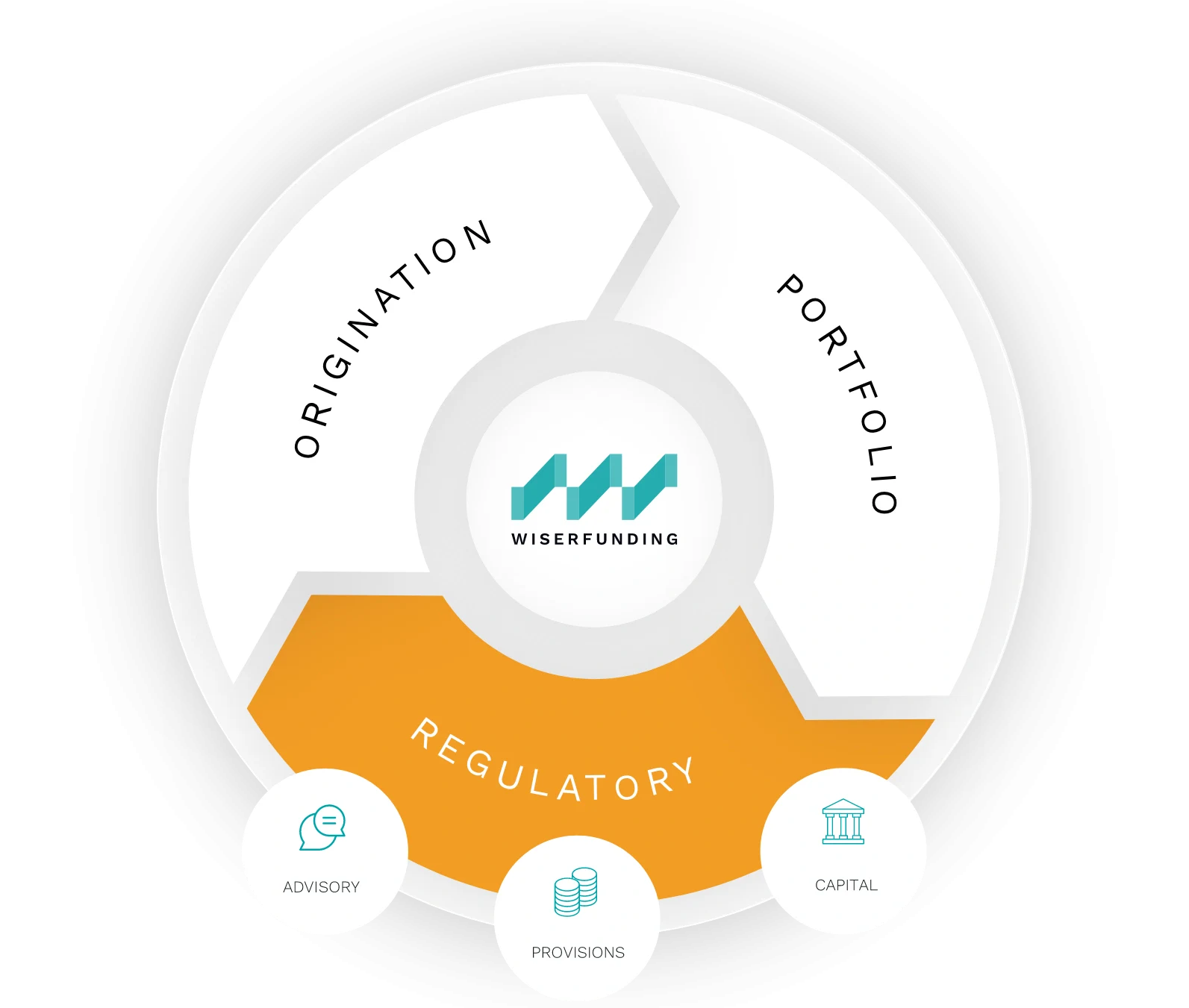

«Wiserfunding allows us to evaluate businesses based on growth potential, not just historical data.»

«As Wiserfunding starts to ingest real-time company performance, updating SME Z-score/BER, we are confident this will help our desire to support our clients growth ambitions.»

«Wiserfunding worked with us to build tailored LGD risk models so our risk function could easily become compliant , with new FCA regulations.»