Sophisticated

models, unrivalled

insights

Sophisticated models, unrivalled insights

Harnessing 20+ years’ SME data for precise, predictive risk modelling

Harnessing 20+ years’ SME data for precise, predictive risk modelling

OUR MODELS

Sophisticated

models, unrivalled

insights

Harnessing 20+ years’ SME data for precise, predictive risk modelling

Built on

a foundation

of expertise

and data

Built on a foundation of expertise and data

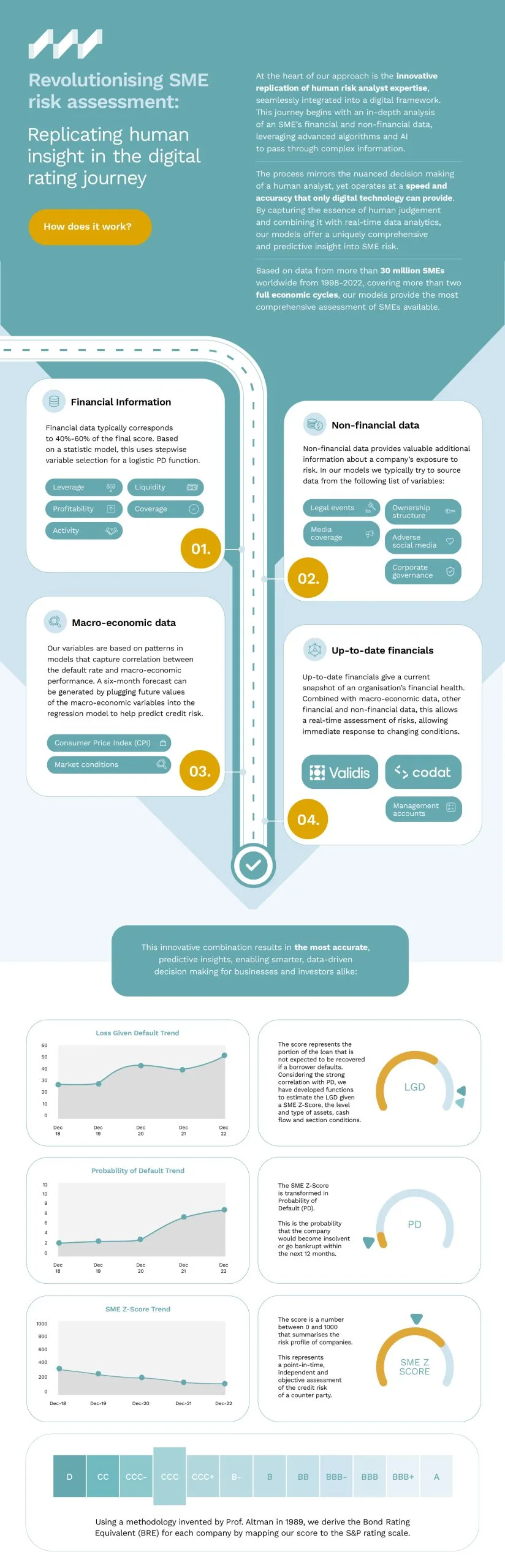

Based on the pioneering work of our co-founder Professor Ed Altman, and our extensive SME data panel, our models incorporate data for more than 30 million SMEs worldwide with a turnover between €1m and €150m.

Using annual data from 1998-2022, more than 2 full economic cycles, our models are as robust as they are detailed.

Detailed risk assessments tailored for SMEs

Each sector-specific SME Z model consists of 3 modules

Module 1

Focused on financial data – the most important driver of the final score.

This module is estimated using a stepwise variable selection process. The selection process accounts for interpretability, adequate balance of factor groups represented and statistical significance.

Module 2

Captures non-financial information such as management experience, legal events, corporate structure, social media engagement and news coverage.

Module 3

Covers macro-economic data to ensure the current state of the economy is adequately reflected. This also enables us to provide forward-looking default risk assessments.

Understanding our models’ mechanics

Case Study

A Regional Bank Enhances Screening and Origination with Wiserfunding

Background:

A regional bank serving the SME sector wanted to speed up their loan origination process while reducing the risk of bad debts. The bank was using a traditional credit scoring model that failed to capture the complex landscape of SME risk.

Implementation:

The bank implemented Wiserfunding for its advanced predictive analytics and immediate access to an intuitive platform. Within just one hour, the team was trained and started screening potential loan applicants using Wiserfunding's sophisticated AI-driven algorithms.

Results:

Time-to-decision

was cut down by 40%.

Accuracy in identifying high-risk applicants improved by 25%.

Loan origination costs reduced by 15% due to the efficiency of the system.

Case Study

A national bank revolutionises underwriting with Wiserfunding

Background:

A national bank was seeking to improve its underwriting process for SME loans. Their existing systems were causing delays and lacked predictive capabilities.

Implementation:

The bank used Wiserfunding's API to integrate its advanced analytics into their existing underwriting workflow. Integration was completed within three hours, and the underwriting team started using the platform immediately.

Results:

Non-performing loans saw a reduction of 20% in the first quarter.

Time spent on underwriting tasks Time spent on underwriting tasks reduced by 30% due to predictive analytics and insights.

Loan profitability improved as better risk assessment led to more accurate pricing.

Case Study

A UK bank optimises portfolio management with Wiserfunding

Background:

A multinational bank was struggling with portfolio management for its SME loans. They faced challenges in identifying emerging risks and taking timely action.

Implementation:

The bank incorporated Wiserfunding's portfolio management solution, leveraging its native integrations with other banking platforms they were already using. A dedicated customer success manager from Wiserfunding ensured smooth implementation.

Results:

Early warning indicators

helped proactively manage risks, reducing potential losses by 10% in the first six months.

Time spent on portfolio analysis was cut in half, allowing for more strategic activities.

Compliance and reporting became more straightforward due to the advanced analytics, reducing manual work and chances of error.

Case Study

An SME Bank Achieves Unprecedented Operational Efficiency with Wiserfunding

Background:

A community-focused bank was grappling with operational bottlenecks in its credit risk management workflow. The bank was heavily reliant on manual processes to collect and analyse credit data, leading to high staff workload and prolonged decision times.

Implementation:

Recognising the need for efficiency, the bank chose Wiserfunding for its cutting-edge technology and ability to integrate seamlessly into their existing systems. With the API integrated in just three hours and staff trained within one hour, the platform was ready for action.

Results:

Instant Data Collection and Analysis: As soon as Wiserfunding was implemented, data collection and analysis that previously took hours, if not days, was executed in a matter of seconds. This was made possible by Wiserfunding's state-of-the-art analytics and AI capabilities.

Staff Reallocated to Value-Added Tasks: Freed from the tedium of manual data collection and basic analysis, staff members were reallocated to more value-added tasks such as customer engagement, strategic planning, and complex risk assessment.

Higher Job Satisfaction: As the staff shifted to more meaningful work, the bank experienced a rise in employee satisfaction scores, resulting in lower turnover and higher productivity.

Boost in Overall Efficiency: By automating the routine but essential process of data collection and preliminary analysis, the bank achieved an overall operational efficiency gain of 35%, a figure that surpassed their initial goals for the project..

Case Study

A Regional Bank Enhances Screening and Origination with Wiserfunding

Background:

A regional bank serving the SME sector wanted to speed up their loan origination process while reducing the risk of bad debts. The bank was using a traditional credit scoring model that failed to capture the complex landscape of SME risk.

Implementation:

The bank implemented Wiserfunding for its advanced predictive analytics and immediate access to an intuitive platform. Within just one hour, the team was trained and started screening potential loan applicants using Wiserfunding's sophisticated AI-driven algorithms.

Results:

Time-to-decision

was cut down by 40%.

Accuracy in identifying high-risk applicants improved by 25%.

Loan origination costs reduced by 15% due to the efficiency of the system.

Case Study

A national bank revolutionises underwriting with Wiserfunding

Background:

A national bank was seeking to improve its underwriting process for SME loans. Their existing systems were causing delays and lacked predictive capabilities.

Implementation:

The bank used Wiserfunding's API to integrate its advanced analytics into their existing underwriting workflow. Integration was completed within three hours, and the underwriting team started using the platform immediately.

Results:

Non-performing loans saw a reduction of 20% in the first quarter.

Time spent on underwriting tasks Time spent on underwriting tasks reduced by 30% due to predictive analytics and insights.

Loan profitability improved as better risk assessment led to more accurate pricing.

Case Study

A UK bank optimises portfolio management with Wiserfunding

Background:

A multinational bank was struggling with portfolio management for its SME loans. They faced challenges in identifying emerging risks and taking timely action.

Implementation:

The bank incorporated Wiserfunding's portfolio management solution, leveraging its native integrations with other banking platforms they were already using. A dedicated customer success manager from Wiserfunding ensured smooth implementation.

Results:

Early warning indicators

helped proactively manage risks, reducing potential losses by 10% in the first six months.

Time spent on portfolio analysis was cut in half, allowing for more strategic activities.

Compliance and reporting became more straightforward due to the advanced analytics, reducing manual work and chances of error.

Case Study

An SME Bank Achieves Unprecedented Operational Efficiency with Wiserfunding

Background:

A community-focused bank was grappling with operational bottlenecks in its credit risk management workflow. The bank was heavily reliant on manual processes to collect and analyse credit data, leading to high staff workload and prolonged decision times.

Implementation:

Recognising the need for efficiency, the bank chose Wiserfunding for its cutting-edge technology and ability to integrate seamlessly into their existing systems. With the API integrated in just three hours and staff trained within one hour, the platform was ready for action.

Results:

Instant Data Collection and Analysis: As soon as Wiserfunding was implemented, data collection and analysis that previously took hours, if not days, was executed in a matter of seconds. This was made possible by Wiserfunding's state-of-the-art analytics and AI capabilities.

Staff Reallocated to Value-Added Tasks: Freed from the tedium of manual data collection and basic analysis, staff members were reallocated to more value-added tasks such as customer engagement, strategic planning, and complex risk assessment.

Higher Job Satisfaction: As the staff shifted to more meaningful work, the bank experienced a rise in employee satisfaction scores, resulting in lower turnover and higher productivity.

Boost in Overall Efficiency: By automating the routine but essential process of data collection and preliminary analysis, the bank achieved an overall operational efficiency gain of 35%, a figure that surpassed their initial goals for the project..

Transforming global financial analysis

«Wiserfunding allows us to evaluate businesses based on growth potential, not just historical data.»

«As Wiserfunding starts to ingest real-time company performance, updating SME Z-score/BER, we are confident this will help our desire to support our clients growth ambitions.»

«Wiserfunding worked with us to build tailored LGD risk models so our risk function could easily become compliant , with new FCA regulations.»