During the last 40 years, risk management has evolved tremendously. The technologies and methodologies to measure risks have reached impressive levels of sophistication and complexity. However, the 2007 to 2008 financial crisis clearly demonstrates that substantial improvements in the way financial institutions measure and manage risks are still urgently needed. This chapter provides an analysis and discussion of risk management as well as several proposals on how the financial industry should evolve.

SIMILAR POSTS

19 July 2021

The link between default and recovery rates: effects on the procyclicality of regulatory capital ratios

BIS Working Papers are written by members of the Monetary and Economic Department of the Bank for International Settlements, and [...]

Credit Risk Scoring Models

Credit scoring models play a fundamental role in the risk management practice at most banks. They are used to quantify [...]

2 June 2021

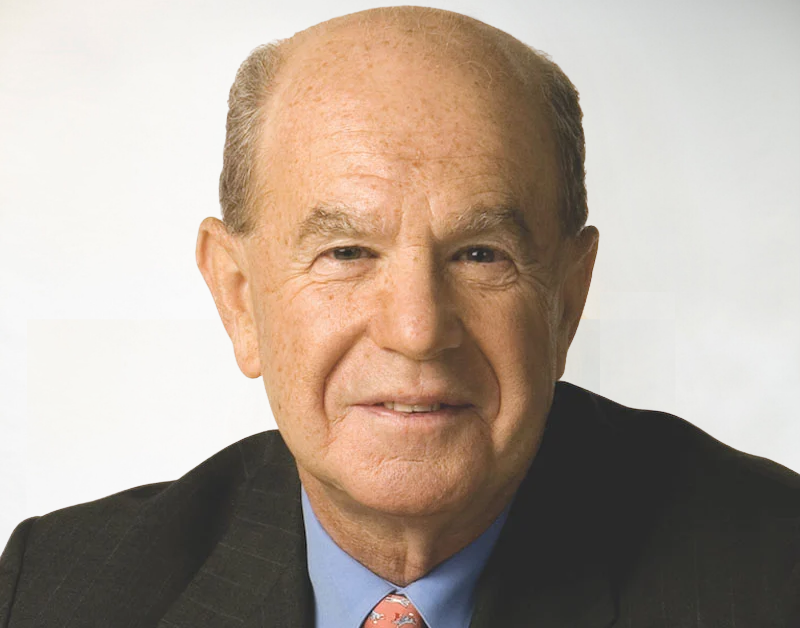

US heading for 2nd largest bankruptcies: Edward Altman

There is no question that the global economy is now in a financial crisis, perhaps unprecedented in its type and [...]