When it comes to understanding credit risk, many models assume that defaults and recovery rates are independent. However, deeper studies reveal that this isn’t quite true. The two factors are closely linked, particularly during economic downturns.

As we step into the volatile environment of 2025, let’s take a closer look at what these metrics mean for credit markets.

Why Defaults and Recoveries Move Together

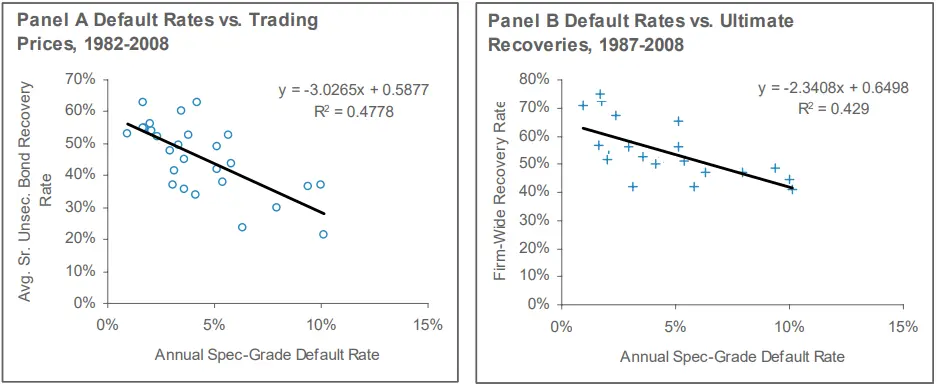

Understanding the link between defaults and recovery rates is essential for private lenders, particularly in times of economic uncertainty. Research by Professor Edward Altman, Andrea Resti and Andrea Sironi highlights that during periods of stress, collateral values tend to decline, which in turn reduces the recoveries creditors can expect. This relationship is crucial for lenders when forecasting credit risk. As defaults increase, recovery rates typically decrease—amplifying the risk of losses that may be greater than initially anticipated.

Consider the 2008 financial crisis, where private lenders faced rising defaults amid rapidly declining recovery rates. As defaults surged, the value of collateral—especially in real estate—dropped, leading to a sharp fall in recovery rates. This combination of higher defaults and lower recoveries exacerbated losses for many lenders.

Source: Moody’s Global Credit Policy. Corporate Default and Recovery Rates, 1920-2008.

Moreover, industry-specific dynamics can amplify or soften this effect. Sectors like gaming and transportation often see sharp fluctuations in recovery rates, with significant drops during economic downturns, making it harder for lenders to forecast and manage risk.

Key Factors in the Default-Recovery Dynamics

Given the ever-changing conditions, it’s evident that multiple factors can influence this relationship. What could shape this dynamic in 2025? Let’s take a closer look:

📊 Macroeconomic Cycles:

Economic downturns typically lead to higher defaults and lower recovery rates, as weaker conditions and declining collateral values take hold. The exact trajectory of these trends will depend on how deep the recessions are, with factors such as inflation, unemployment rates, exchange rate movements, and changes in consumer and business sentiment likely shaping both defaults and recovery rates in 2025.

🌍 Government Policy:

Government interventions, like stimulus packages, play a key role in recovery outcomes. During the COVID-19 pandemic, these measures helped stabilise markets, resulting in higher-than-expected recovery rates. In 2025, however, shifts in policy—like U.S. protectionism or geopolitical tensions—could significantly impact the default-recovery dynamic, adding complexity to the credit landscape.

⚖️ Regulatory Changes and Procyclicality:

Regulatory frameworks, such as Basel III, guide banks in managing credit risk by promoting stronger capital buffers during economic stress, which helps stabilise recovery rates. In 2025, regulations like DORA will play an increasingly important role in strengthening operational resilience and managing third-party risks, further influencing recovery rates.

Ultimately, how these dynamics unfold will depend on the broader economic and market conditions throughout the year.

Preparing for Change: Advice and Practice

At Wiserfunding, we recognise the complexities of defaults and recovery rates in today’s dynamic market. To help clients stay ahead, we recommend focusing on a proactive, diversified approach to managing credit risk, backed by expert insights and advanced tools:

💡By combining data-driven tools with expert support, we’re helping investors develop strategies resilient to any changes

References

- Edward I. Altman, Brooks Brady, Andrea Resti, Andrea Sironi. The Link between Default and Recovery Rates: Theory, Empirical Evidence, and Implications.

- Yen-Ting Hu and William Perraudin. The Dependence of Recovery Rates and Defaults.

- European Investment Bank. Default and recovery statistics: Private and public lending 1994-2023.

SIMILAR POSTS

23 July 2025

NEITEC and Wiserfunding: A strategic partnership redefining SME access to finance

At Wiserfunding, we are proud to announce our partnership with NEITEC, a platform dedicated to unlocking financing opportunities for [...]

23 July 2025

Harvey Nijjar Discusses Multifi’s Strategy and Partnership with Wiserfunding

Multifi is a UK-based financial platform providing flexible, unsecured credit to small and medium-sized businesses for managing cash flow, [...]

Key Credit Risks From the IMF’s Global Financial Stability Report

Lending Into Fragility: Key Risks From the IMF’s Global Financial Stability Report For lenders navigating deteriorating credit conditions, the IMF’s [...]