Credit scoring models play a fundamental role in the risk management practice at most banks. They are used to quantify credit risk at counterparty or transaction level in the different phases of the credit cycle (e.g. application, behavioural, collection models). The credit score empowers users to make quick decisions or even to automate decisions and this is extremely desirable when banks are dealing with large volumes of clients and relatively small margin of profits at individual transaction level (i.e. consumer lending, but increasingly also small business lending).

SIMILAR POSTS

19 July 2021

The link between default and recovery rates: effects on the procyclicality of regulatory capital ratios

BIS Working Papers are written by members of the Monetary and Economic Department of the Bank for International Settlements, and [...]

Measuring and Managing Credit and Other Risks

During the last 40 years, risk management has evolved tremendously. The technologies and methodologies to measure risks have reached impressive [...]

2 June 2021

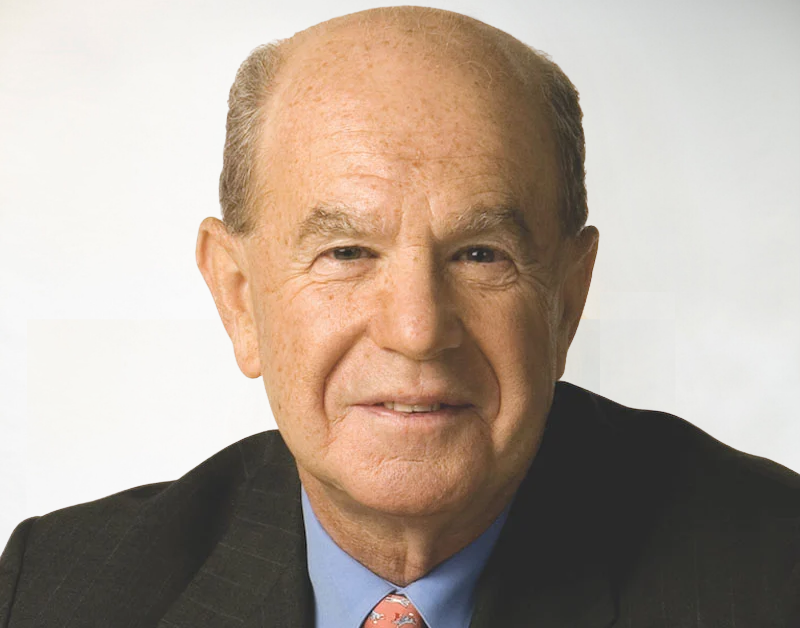

US heading for 2nd largest bankruptcies: Edward Altman

There is no question that the global economy is now in a financial crisis, perhaps unprecedented in its type and [...]