Turn Risks into Opportunities

Focus on Growing Investor Wealth –

We’ll Back You with Real-Time Data For Your Portfolio Management

Wiserfunding saves time for asset managers by automating data collection and risk analysis, delivering real-time insights into portfolio performance. Make confident, data-driven decisions that enhance returns and protect investor wealth.

Asset Managers

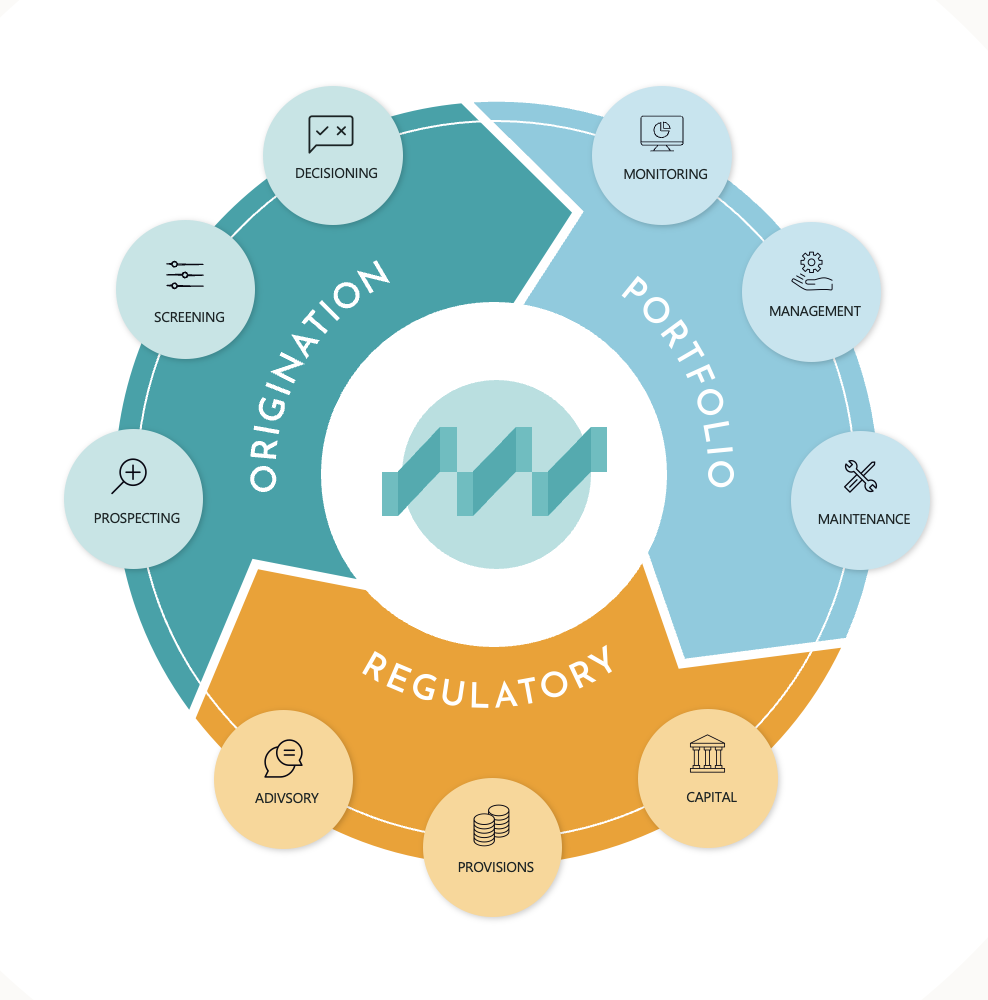

Transform Your Investment Strategies with our AI-Powered Credit Risk Solutions for the Full Credit Cycle:

Origination, Portfolio and Regulatory – all in one platform!

OUR PLATFORM

Intuitive platform,

empowering

decisions

Explore the nuances of SME lending with our intuitive and information-packed platform

SEE WHAT YOU CAN ACCOMPLISH WITH WISERFUNDING

Origination Solutions

Our platform provides access to relevant financial and non-financial data for over 30 million SMEs, each downloadable in under 4 seconds. This capability enables you to identify high-potential investment opportunities and build a robust portfolio from the start.

Portfolio Solutions

We enable real-time management of your personalised portfolio, offering up-to-date insights of SME.

With automated monitoring and alerts, you can proactively manage risks and seize opportunities.

Plus, our non-financial and sector benchmarks help you evaluate performance and enhance your strategic planning.