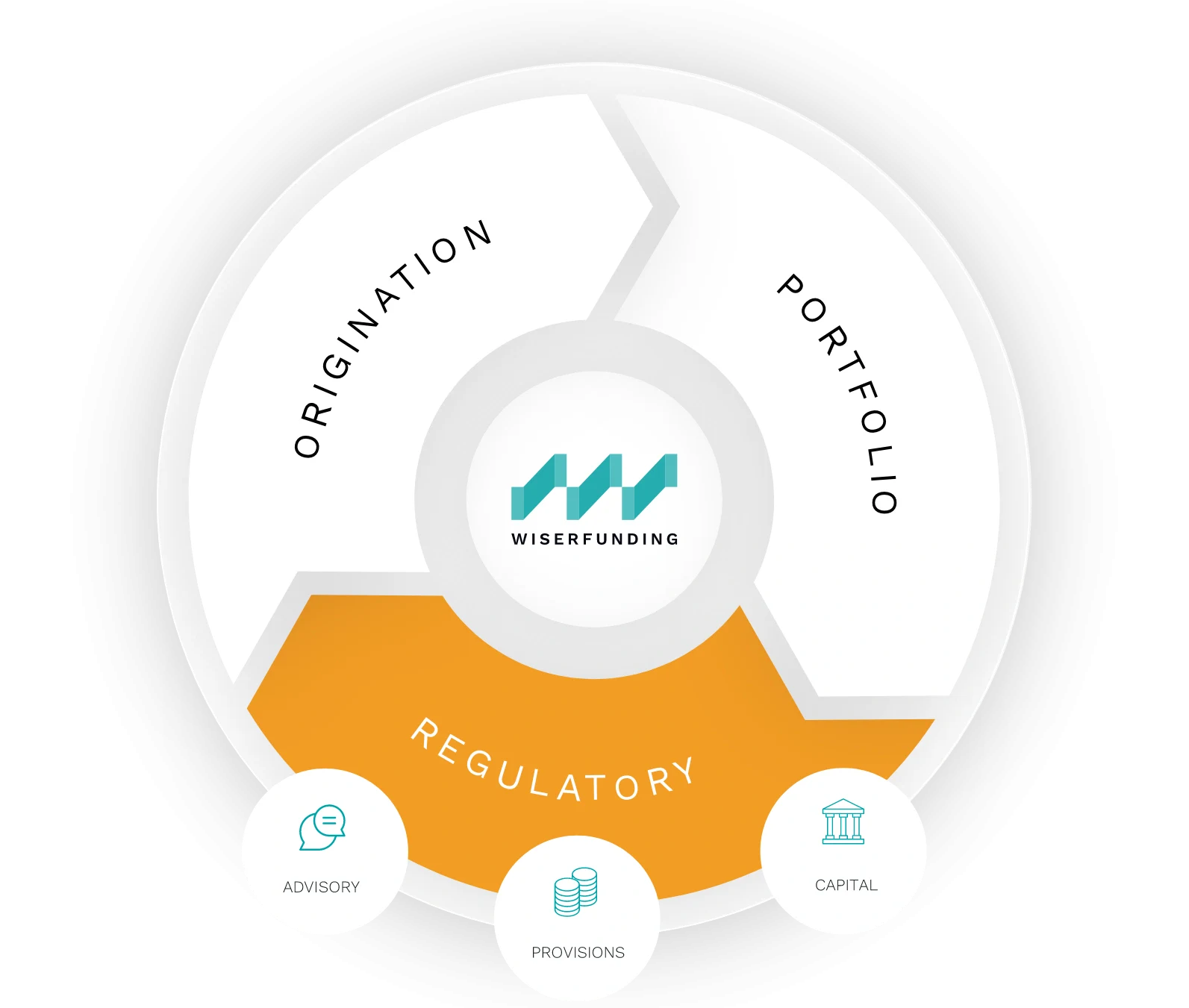

Regulatory

Navigate the compliance landscape with confidence.

Wiserfunding’s Regulatory Solution helps you seamlessly integrate compliance into your strategy.

Regulatory

Navigate the compliance landscape with confidence.

Wiserfunding’s Regulatory Solution helps you seamlessly integrate compliance into your strategy.

Streamlined

compliance

Streamlined compliance

Regulation compliance built in from the outset

Integrating all levels of regulation and red tape

For a simpler way to accommodate regulation into your strategy

Automated

compliance

Automated compliance

Using tech to run continuous compliance checks

Optimised provisioning in-built

For a faster, more efficient way to ensure compliance

24/7

compliance

24/7 compliance

Using AI to constantly scan changing regulatory environment

Instantly accommodating changing directives

Giving you confidence your portfolio is always compliant

Key features of our

Regulatory Solution

Key features of our

Regulatory Solution

01 Inbuilt AI technology to constantly adjust to evolving regulatory environment

02 Automated, in-built compliance checks to save hiring in-house advisors

03 Integrated custom risk IFRS9-compliant models

SaaS solution for seamless integration with your existing systems, for minimal disruption

Take the headache out of compliance and feel confident your portfolio always adheres to the rules.

Streamline processes

Make faster decisions in full confidence that our solution keeps you in line with the latest regulations.

Automate vetting and checking procedures with a platform that integrates into your existing processes.

Build compliance into your strategy from the outset.

Plan smarter

Concentrate on the strategic decisions, leaving us to deal with the regulatory stuff.

Test the resilience of your portfolio under a range of market conditions by subjecting it to simulated ICAAP-compliant scenarios.

Use our solution to help you adhere to the rules and gain a better sense of your position in the market.

Easier reporting

Generate fully compliant reports at the click of a button – incorporating all key metrics and presented with clear, arresting visuals.

Improve transparency within your organisation with tools that offer clear, straightforward explanations.

WANT TO BOOK A DEMO?

Why Wiserfunding?

Why Wiserfunding?

70+ years’ expertise

Founded by leading authorities

in field of credit risk

AI and machine learning

built into solution

to speed data processing

More data

sorted than any of our competitors for richer insights

Proprietary models

that are constantly enriched through machine learning

30% more accurate

risk profiles than market standard

Live financial data

from open banking

and accounting systems

SaaS solution

for easy integration

with existing programmes

Instant value

Delivering insights

from moment you log in

Customisable elements

for a product that

suits your risk appetite

FAQs

Our solutions are designed to tackle the unique challenges of this sector. We provide accurate and timely Credit Risk Analysis, including standardised risk metrics across multiple geographies. This gives lenders deeper insights and improves origination, making us a better choice than traditional risk assessment providers.

Wiserfunding’s platform supports organisations worldwide. Our flexible solutions adapt to various industries, ensuring accurate Credit Risk Analysis. No matter of your location or sector, our technology can be customised to fit your business needs and improve origination processes.

Wiserfunding simplifies Credit Risk Analysis with predictive assessments, real-time analytics, and regulatory support. Our platform accelerates underwriting, improves risk models, and enhances origination. This helps reduce defaults, optimise portfolio management, and boost financial performance.

Wiserfunding combines combines financial and non-financial data for precise Credit Risk Analysis. We integrate financial statements, industry data, corporate governance, legal events, social media, and macroeconomic trends. Our models update continuously, ensuring accurate and timely insights to support better origination decisions.

We provide highly customisable risk models highly customisable risk models designed to meet your specific business needs.

Our platform integrates seamlessly with popular lending systems like nCino. Plus, we offer extensive post-sales support and training to ensure a smooth transition, enhancing your Credit Risk Analysis and origination process.

Yes!

Wiserfunding helps you stay compliant with financial regulations across various jurisdictions, including IFRS9 calculations.

Our solutions are designed to align with the constantly changing regulatory landscape, giving you peace of mind in your Credit Risk Analysis and origination processes.

We offer comprehensive post-sales support and training post-sales support and training to ensure your team uses our platform effectively.

Our dedicated support team is always available to assist with any queries or issues, ensuring a smooth experience for your Credit Risk Analysis and origination needs.

Pricing for Wiserfunding’s solutions varies based on your specific needs and the scale of your operations.

We offer flexible pricing models that can scale with your business, along with additional professional services. Our goal is to ensure our pricing structure aligns with your business’s budget and supports your Credit Risk Analysis and origination requirements.

Certainly, we have a range of case studies and customer references available upon request.

These resources showcase real-world examples of how Wiserfunding has helped businesses improve Credit Risk Analysis, reduce defaults, and enhance financial performance, making origination decisions more accurate and reliable.

Feel free to reach out to our team for more detailed information or to request specific case studies and references tailored to your industry or use case.

Trusted by Industry leaders:

«Wiserfunding allows us to evaluate businesses based on growth potential, not just historical data.»

«As Wiserfunding starts to ingest real-time company performance, updating SME Z-score/BER, we are confident this will help our desire to support our clients growth ambitions.»

«Wiserfunding worked with us to build tailored LGD risk models so our risk function could easily become compliant , with new FCA regulations.»