How to make confident decisions in today’s economy?

How to make confident decisions in today’s economy?

«Bringing in Wiserfunding’s independent and seasoned view helped us triangulate risk assessments, validate our thinking, and ultimately strengthen our confidence in the portfolio.

Having that third lens — objective, data-driven, and methodologically distinct — was of tremendous value to us.»

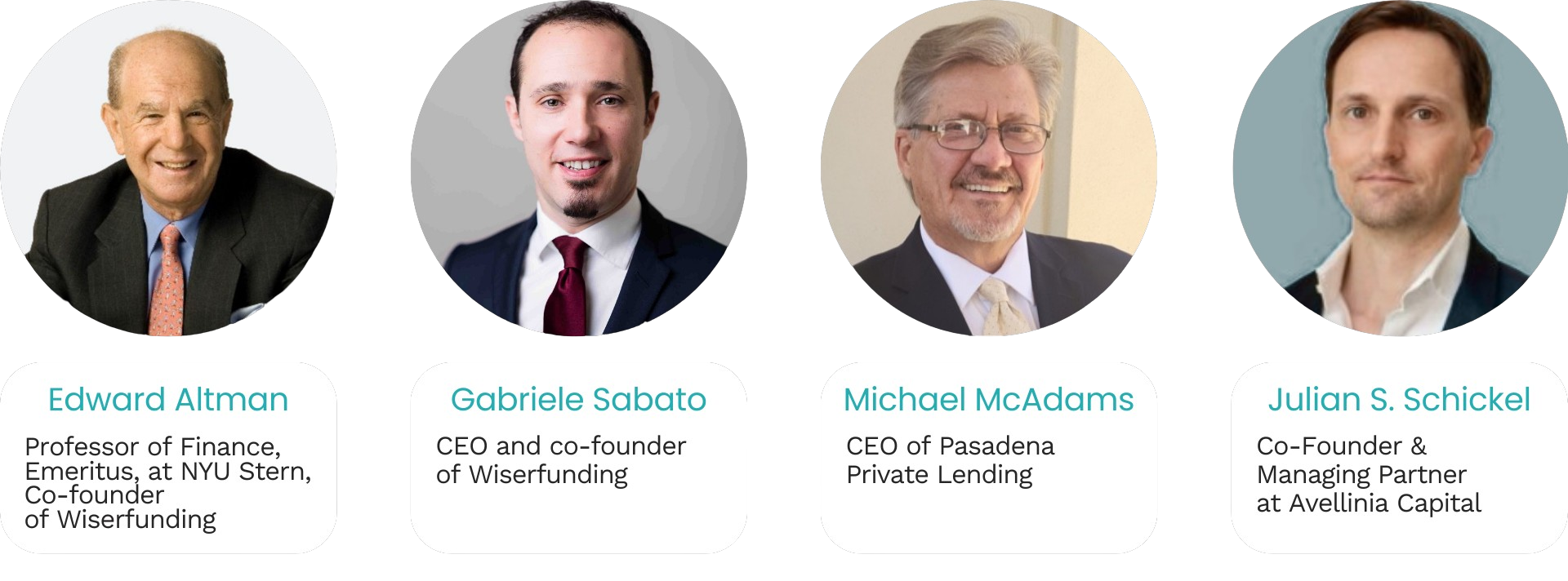

— Julian S. Schickel, Co-founder, Avellinia Private Capital

«Wiserfunding provides crucial third-party validation that helps us bypass the limitations of traditional rating agencies. These agencies often start with low ratings for smaller companies, assuming they are more vulnerable. Wiserfunding, however, enables us to demonstrate that while our borrowers may be smaller, they are not weaker. By combining our own data with Wiserfunding’s insights, we can clearly showcase the strength and potential of these businesses, allowing us to make better, more informed decisions in our underwriting process.»

— Michael McAdams, CEO of Pasadena Private Lending

«According to most investment banks, over 60% of economists now predict that the United States will face a recession within the next year. This is a significant increase from the 30-40% probability we saw before the tariff situation escalated.»

— Edward Altman, Professor of Finance, Emeritus, at NYU Stern, Co-founder of Wiserfunding

«Bringing in Wiserfunding’s independent and seasoned view helped us triangulate risk assessments, validate our thinking, and ultimately strengthen our confidence in the portfolio.

Having that third lens — objective, data-driven, and methodologically distinct — was of tremendous value to us.»

— Julian S. Schickel, Co-founder, Avellinia Private Capital

«Wiserfunding provides crucial third-party validation that helps us bypass the limitations of traditional rating agencies. These agencies often start with low ratings for smaller companies, assuming they are more vulnerable. Wiserfunding, however, enables us to demonstrate that while our borrowers may be smaller, they are not weaker. By combining our own data with Wiserfunding’s insights, we can clearly showcase the strength and potential of these businesses, allowing us to make better, more informed decisions in our underwriting process.»

— Michael McAdams, CEO of Pasadena Private Lending

Exploring ways to sharpen your credit strategy?

We’ll walk you through how our tools can strengthen your credit decisions using data-driven, cost-efficient risk assessment.

Turning Risks into Opportunities

Want the insights, but can’t attend? Register anyway — We’ll send you the slides.

Want to learn how our tools can help you sharpen your strategies?

Our team is here to guide you!