Key features of our Origination Solution

Key features of our

Origination Solution

Screen faster

Our platform automatically screens every prospect, removing the manual work from the assessment process.

With clear, easy-to-understand graphs and charts, you can quickly grasp the company’s performance.

Seamlessly integrated into your systems, our platform enhances your Credit Risk Analysis. It streamlines origination, making your processes more efficient and your job easier.

Predict defaults

Gain a clearer view of company performance by analysing both past and future trends to identify patterns and potential risks.

Spot market trends or track economic cycles to better understand a company’s vulnerability.

Simulate different scenarios to assess a company’s resilience and improve your Credit Risk Analysis and origination decisions.

Informed decisions

Build a more accurate company profile using live financial data accessed in real time, not outdated filed accounts.

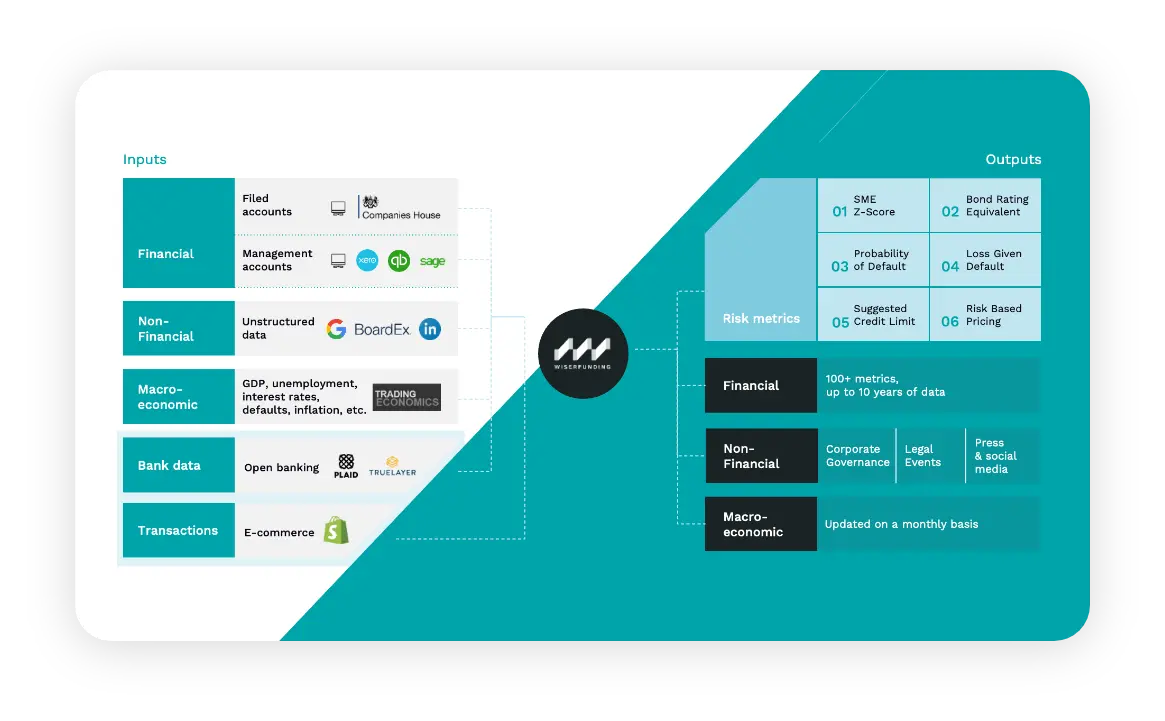

Get a complete 360-degree view of every company, drawing from a wide range of data—financial, non-financial, and macro-economic.

Make confident Credit Risk Analysis and origination decisions with 30% more accurate risk profiles.

Lend more

Speed up the approval process and automate laborious manual tasks.

Discern real from perceived risk and feel confident you will never again reject another company that is ripe for investment.

Spot approaching threats and take early measures to mitigate them.

Scale operations quickly and easily.

Feel free to reach out to our team for more detailed information or to request specific case studies and references tailored to your industry or use case.