How AI Drives Our Solutions at Wiserfunding

At Wiserfunding, AI is at the heart of our cutting-edge solutions. Our technology now delivers precise credit risk assessments in seconds, empowering lenders to make quick and effective decisions. This advancement highlights how AI is reshaping the financial industry by addressing issues like slow decision-making and disorganised workflows.

AI’s Impact on the Financial Industry

AI is transforming SME lending by updating outdated processes with automation. It speeds up credit assessments, boosts accuracy, and facilitates quicker loan approvals using advanced predictive models and real-time risk management. Additionally, AI enhances compliance and security by rapidly detecting fraud and handling large datasets, resulting in more efficient operations and tailored service for SME lenders.

However, AI regulation remains in its early stages, with substantial gaps in available information. It will take time to determine the best practices for implementation and to see how governments address future regulatory requirements. The current advances in computing power allow for more sophisticated data processing and AI model training, with a shift towards models that better simulate human behaviour and thought. This evolution represents a major leap in AI technology, driving significant changes in the financial industry.

How AI Enhances Automation

Operational Efficiency and Enhanced Decision-Making: AI automates repetitive tasks, boosting efficiency and allowing staff to focus on strategic activities. By rapidly processing data, AI supports more precise and informed decisions, notably accelerating the credit decision making from lead enquiry to loan approval.

Advanced Model Development and Efficient Data Processing: AI excels in developing and refining predictive models, which are crucial for accurate risk assessment and evaluating creditworthiness. It also processes and analyses large datasets to extract valuable insights, improving decision-making and providing a comprehensive view beyond traditional methods.

Proactive Risk Management and Improved Compliance: AI enhances regulatory compliance by detecting suspicious activities and fraud in real-time, safeguarding assets and ensuring adherence to regulations. Additionally, AI’s real-time alerts and early warnings help manage and mitigate risks proactively, addressing potential threats before they escalate.

To maximise AI’s potential, begin by identifying key processes and analysing where AI can add the most value. This approach can significantly reduce the time required to move from lead enquiry to loan approval, streamlining the entire process.

To maximise AI’s potential, begin by identifying key processes and analysing where AI can add the most value. This approach can significantly reduce the time required to move from lead enquiry to loan approval and then portfolio management and monitoring, streamlining the entire process.

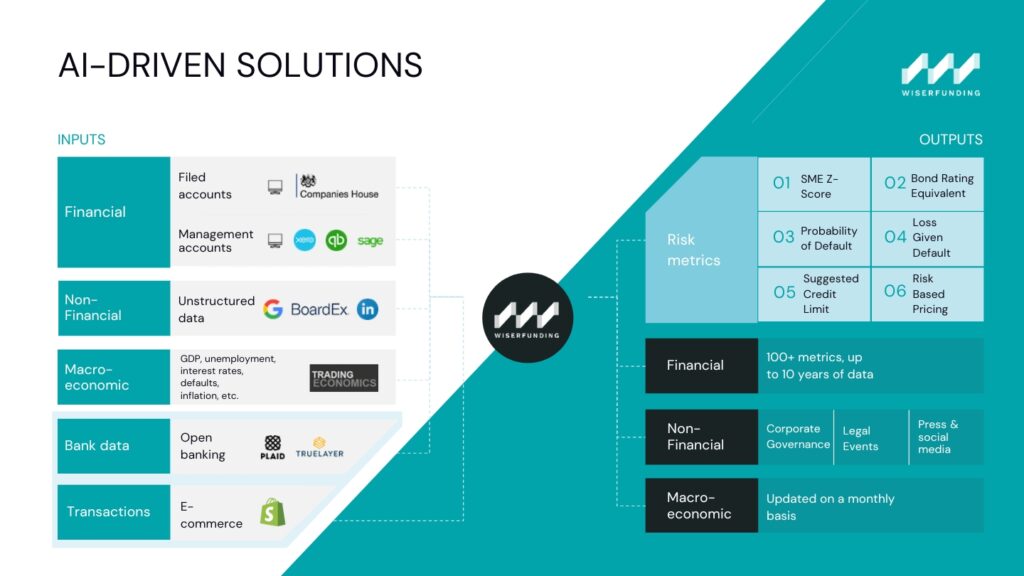

How Wiserfunding Solutions Transform SME Lending:

Wiserfunding’s AI-driven solutions revolutionise the credit lifecycle for SME lenders by improving efficiency, accuracy, and speed at every stage. From automated data collection to tailored risk assessments and proactive monitoring, our technology helps lenders navigate the financial landscape with ease.

Contact us today to learn more and elevate your credit management to the next level

SIMILAR POSTS

19 May 2021

New fintech partnership aims to protect SMEs against insolvent customers

This support SMEs to continue trading, especially since the number of UK SMEs in significant financial distress has reached over [...]

19 May 2021

Managing Credit Risk For Retail Low-Default Portfolios

Low-Default Portfolios (LDPs) form a significant and substantial portion of retail assets at major financial institutions. However, in the literature, [...]

19 April 2021

CEO of Wiserfunding comments on Small Business Survey 2018

Dr. Gabriele Sabato, former head of Risk Appetite Portfolio Decisioning at RBS and CEO, co-founder of Wiserfunding, comments on SME lending in conjunction with [...]