Credit Software for Complete Credit Portfolio Management

1 million borrower profiles and 100+ financial metrics

Early Warning Alerts, Customised to your needs

Intuitive Navigation for Streamlined Workflows

Get Full-Spectrum Insights

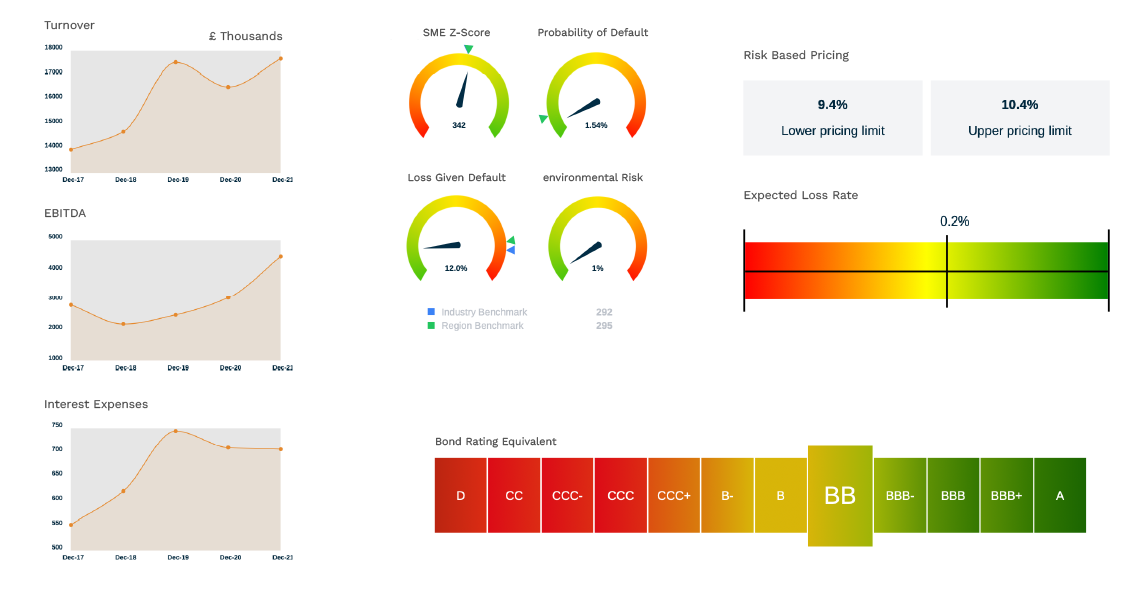

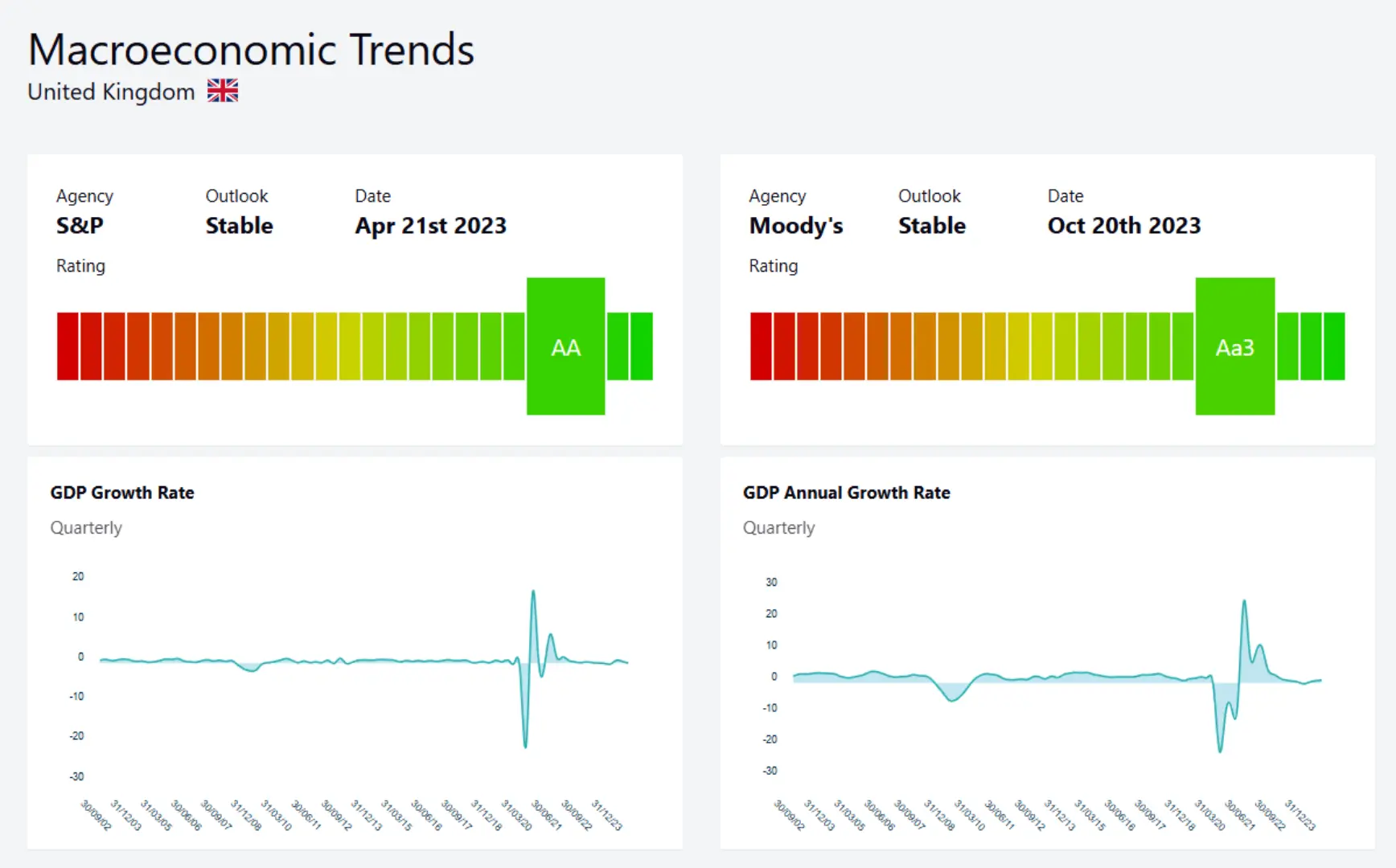

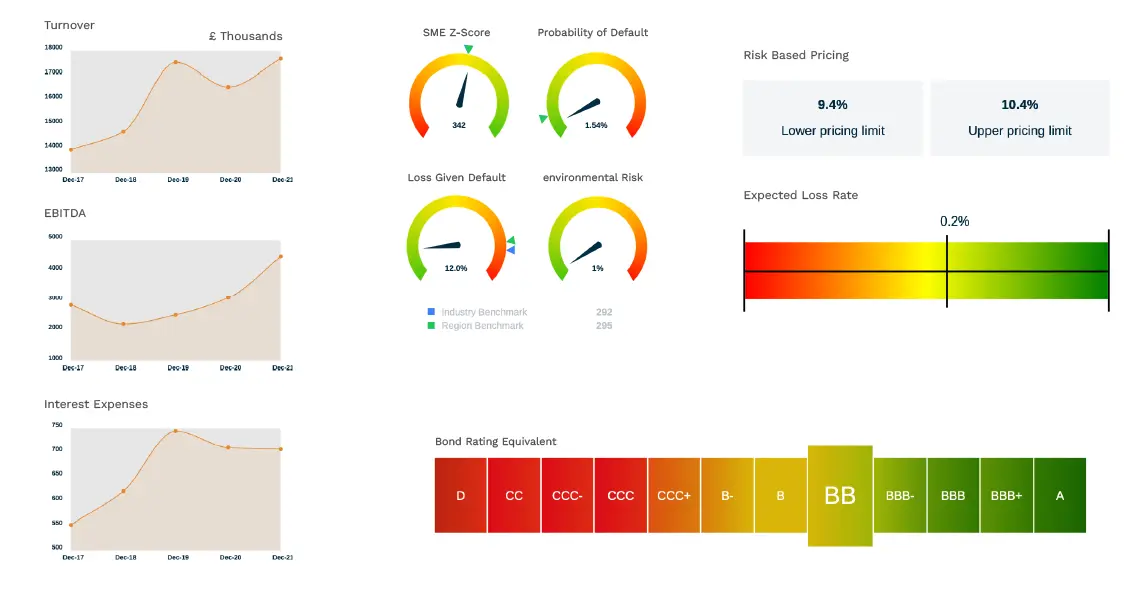

Analysing 100+ financial metrics and multiple non-financial sources from 45+ countries in seconds, our platform filters critical risks from data noise, giving lenders a sharper, faster, and more reliable decision-making edge.

Embrace Smart Portfolio Performance

Proactive warning indicators filter critical risks, and with our intuitive, customisable credit portfolio management software, you save time and focus on what matters most for smarter strategies.

Simplify Decision-making

Our credit risk monitoring platform visualises data analytics, providing all the metrics you need for holistic risk assessment and portfolio management—all on a single webpage.

Expertise is Our Power

Wiserfunding was founded by Prof. Edward Altman and Dr. Gabriele Sabato with a mission to empower businesses through deep insights.

In our team, we embrace deep expertise, ensuring our financial experts are always ready to provide the support you need.

Wiserfunding allows us to evaluate businesses based on growth potential, not just historical data.

As Wiserfunding starts to ingest real-time company performance, updating SME Z-score/BER, we are confident this will help our desire to support our clients growth ambitions.

Wiserfunding worked with us to build tailored LGD risk models so our risk function could easily become compliant with new FCA regulations.