Unlock Effortless Value

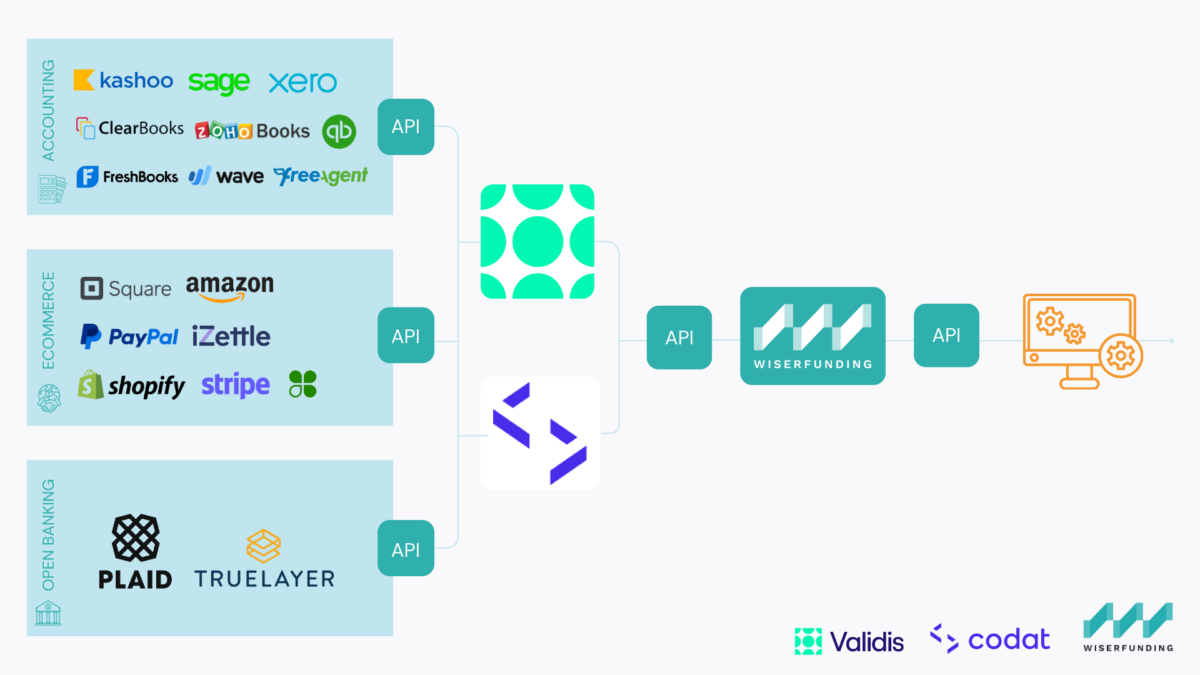

Access full-spectrum insights

Access full-spectrum insights

Focus on what matters. We’ll take care of everything else

Focus on what matters.

We’ll take care of the rest

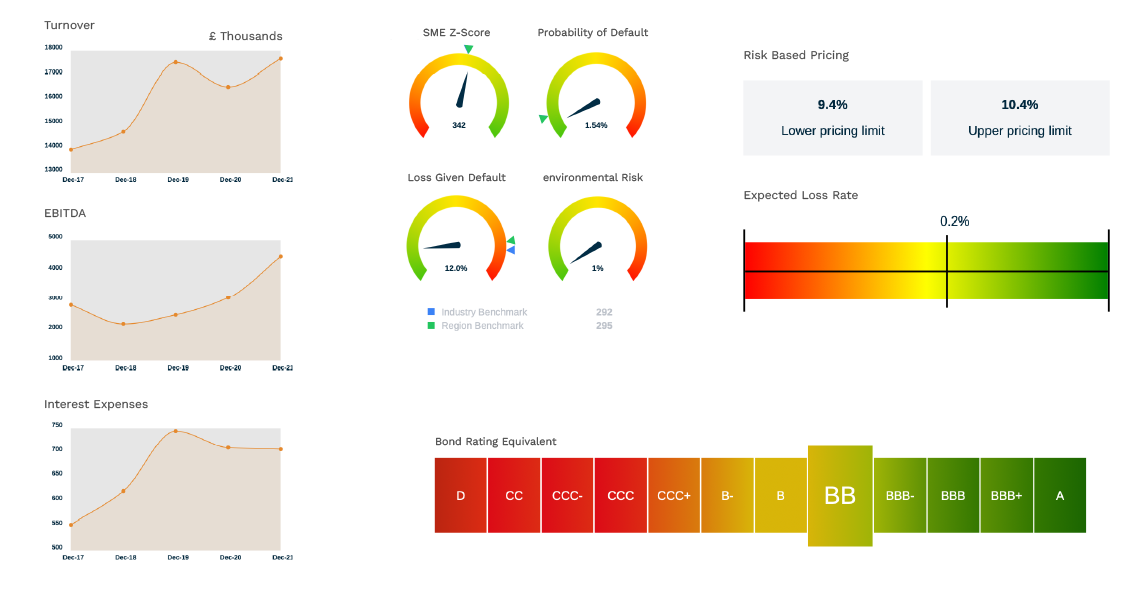

“We get data in 15 seconds that banks and credit bureaus don’t, and the integration with our credit analytics enables us to make good, fast lending decisions”

“Wiserfunding gives us a complete and uniform tool for analysis that should be the industry standard.

It blows away anything I’ve seen for credit reporting for SMEs”

“Wiserfunding worked with us to build tailored LGD risk models so our risk function could easily become compliant with new FCA regulations.”

“We get data in 15 seconds that banks and credit bureaus don’t, and the integration with our credit analytics enables us to make good, fast lending decisions”

“Wiserfunding gives us a complete and uniform tool for analysis that should be the industry standard.

It blows away anything I’ve seen for credit reporting for SMEs”

“Wiserfunding worked with us to build tailored LGD risk models so our risk function could easily become compliant with new FCA regulations.”

Have questions? Feel free to connect with us any time

Have questions? Feel free to connect with us any time